Europe’s AI Startups Look Stateside for Bigger Checks, Quicker Deals

PositiveFinancial Markets

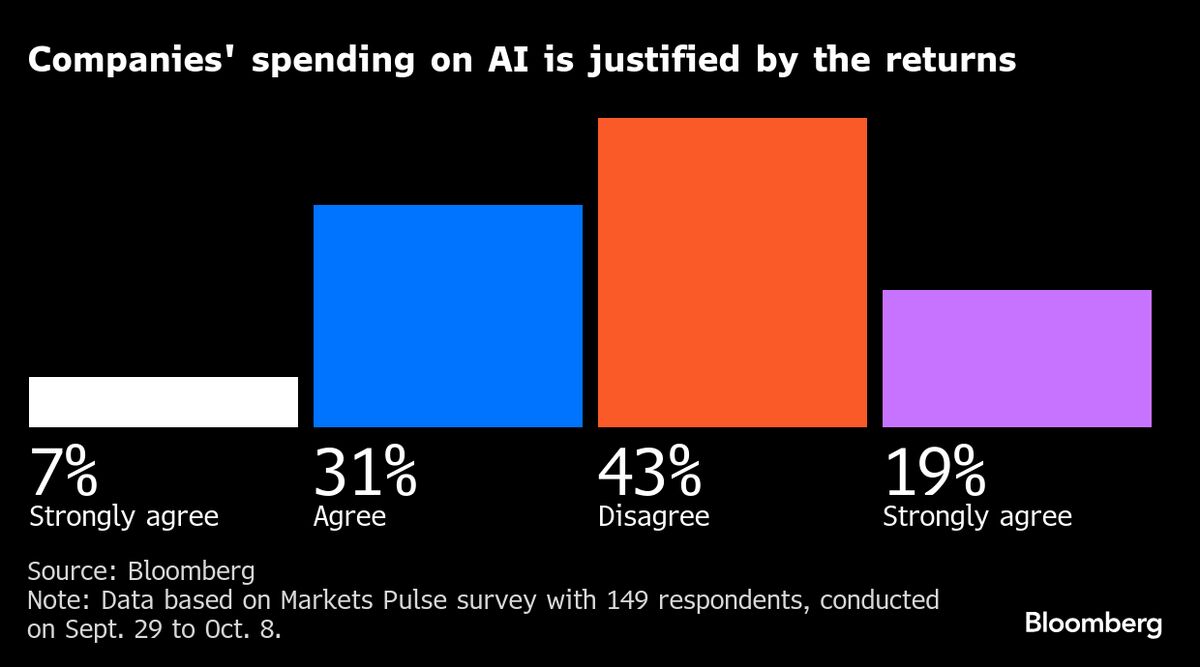

European AI startups are increasingly turning to U.S. investors for funding, as they find them more aligned with the rapid pace and significant upfront costs associated with artificial intelligence development. This shift is significant because it highlights the growing importance of U.S. capital in the tech landscape, potentially accelerating innovation and growth in the AI sector.

— Curated by the World Pulse Now AI Editorial System