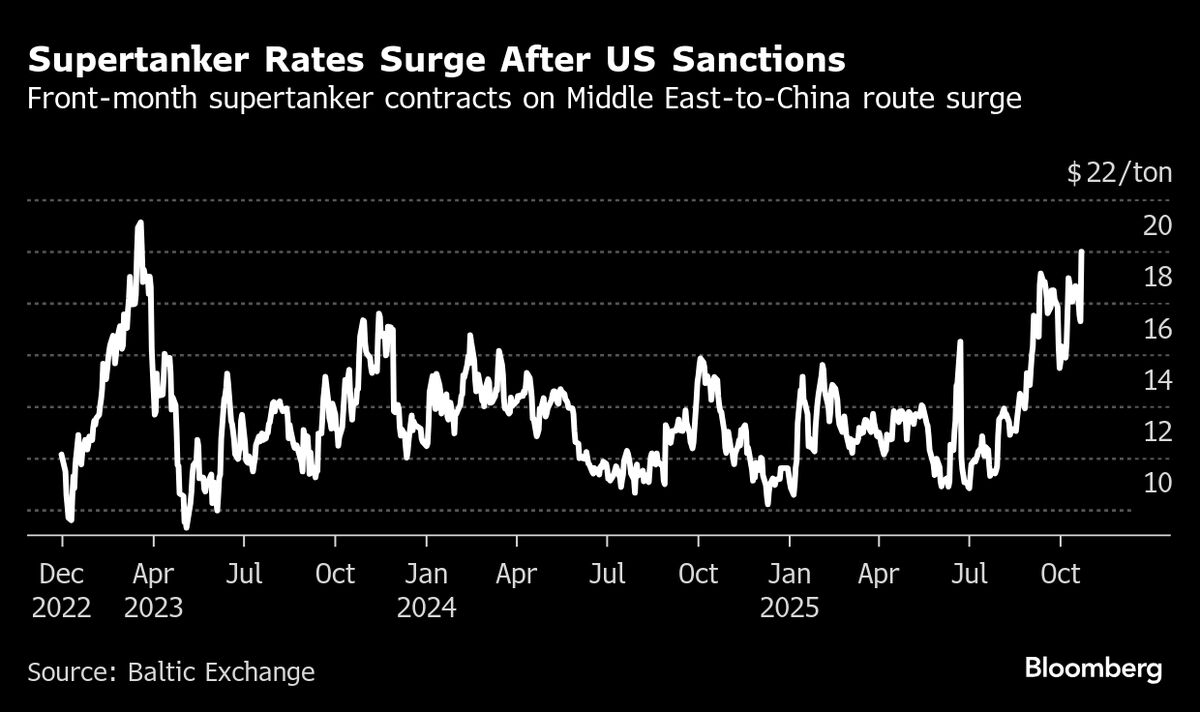

Oil extends gains after settlement on new sanctions on Russian oil companies

PositiveFinancial Markets

Oil prices are on the rise following a recent settlement regarding new sanctions imposed on Russian oil companies. This development is significant as it reflects the ongoing geopolitical tensions and their impact on global oil supply. Investors are optimistic about the potential for higher prices, which could benefit oil-producing nations and companies. The market's reaction indicates a strong belief that these sanctions will further restrict Russian oil exports, thereby tightening supply and driving prices up.

— Curated by the World Pulse Now AI Editorial System