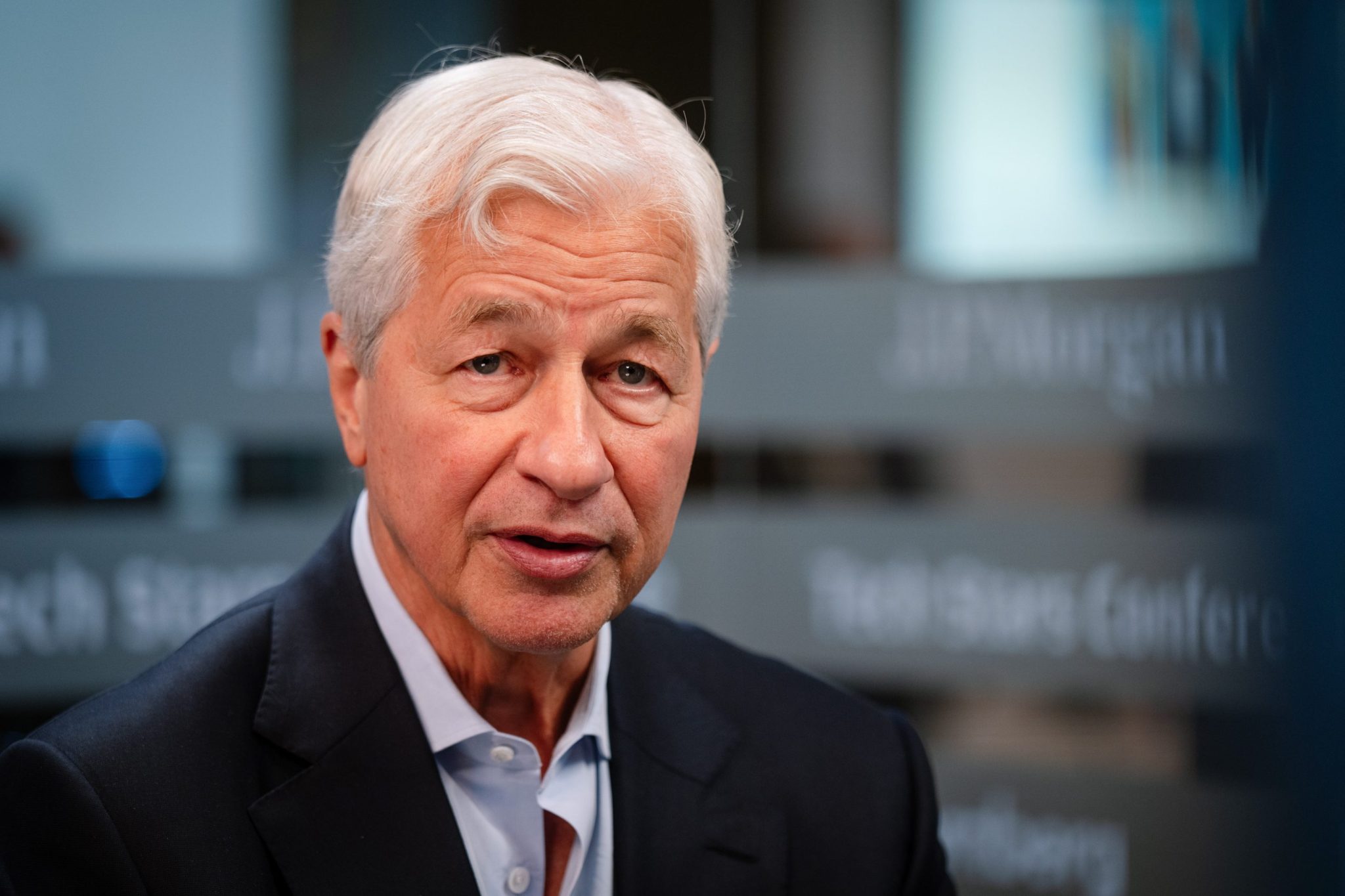

JPMorgan CEO Jamie Dimon Issues Stark Warning on U.S. Stock Market

NegativeFinancial Markets

JPMorgan CEO Jamie Dimon has issued a stark warning regarding the U.S. stock market, expressing concerns about potential downturns. This matters because Dimon's insights often reflect broader economic trends, and his caution could signal challenges ahead for investors and the economy as a whole.

— Curated by the World Pulse Now AI Editorial System