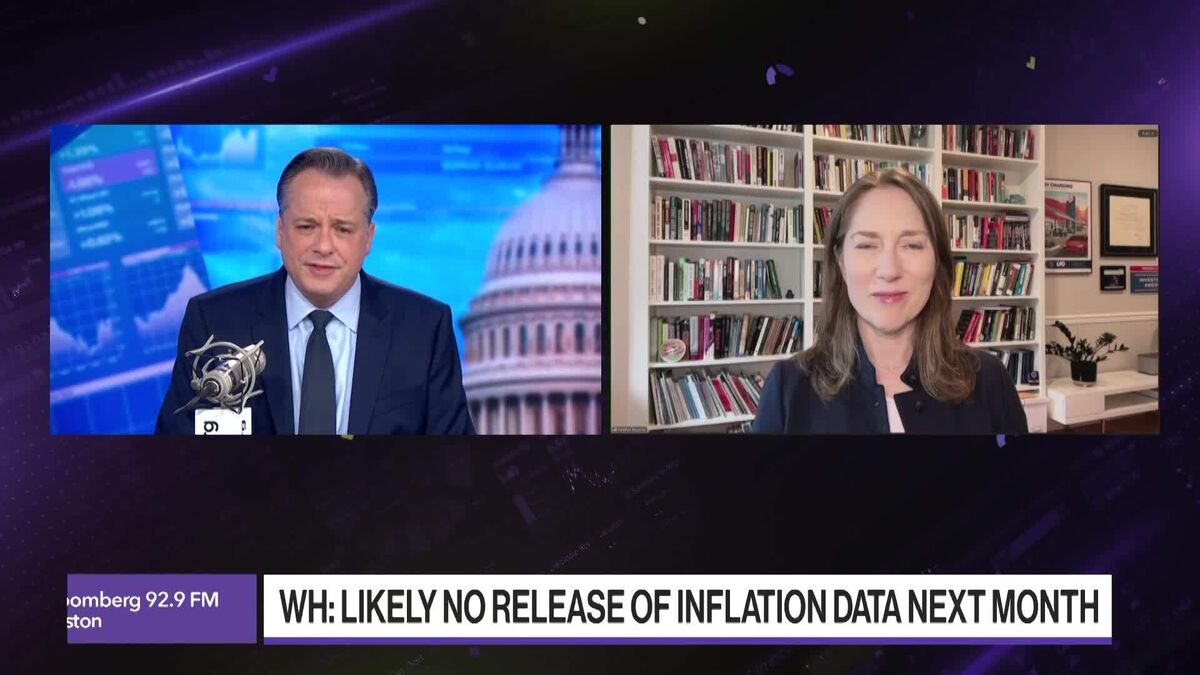

The extended government shutdown has put collecting most October inflation data out of reach for the Bureau of Labor Statistics, according to people familiar with the agency’s operations

NegativeFinancial Markets

The ongoing government shutdown is hindering the Bureau of Labor Statistics from collecting crucial October inflation data, which could have significant implications for economic analysis and policy-making. This situation highlights the broader impact of political gridlock on essential government functions and the potential consequences for economic forecasting.

— Curated by the World Pulse Now AI Editorial System