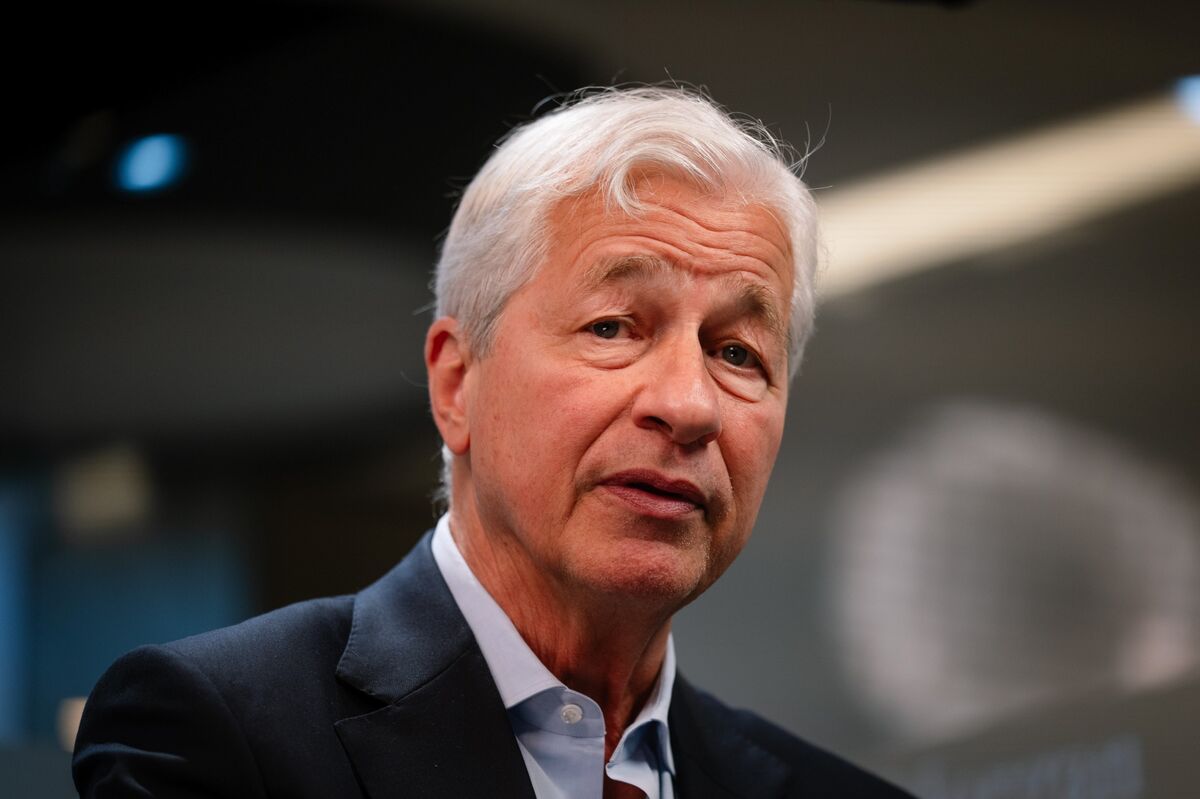

JPMorgan Chase boosted by dealmaking, but CEO flags wider "uncertainty" ahead

NeutralFinancial Markets

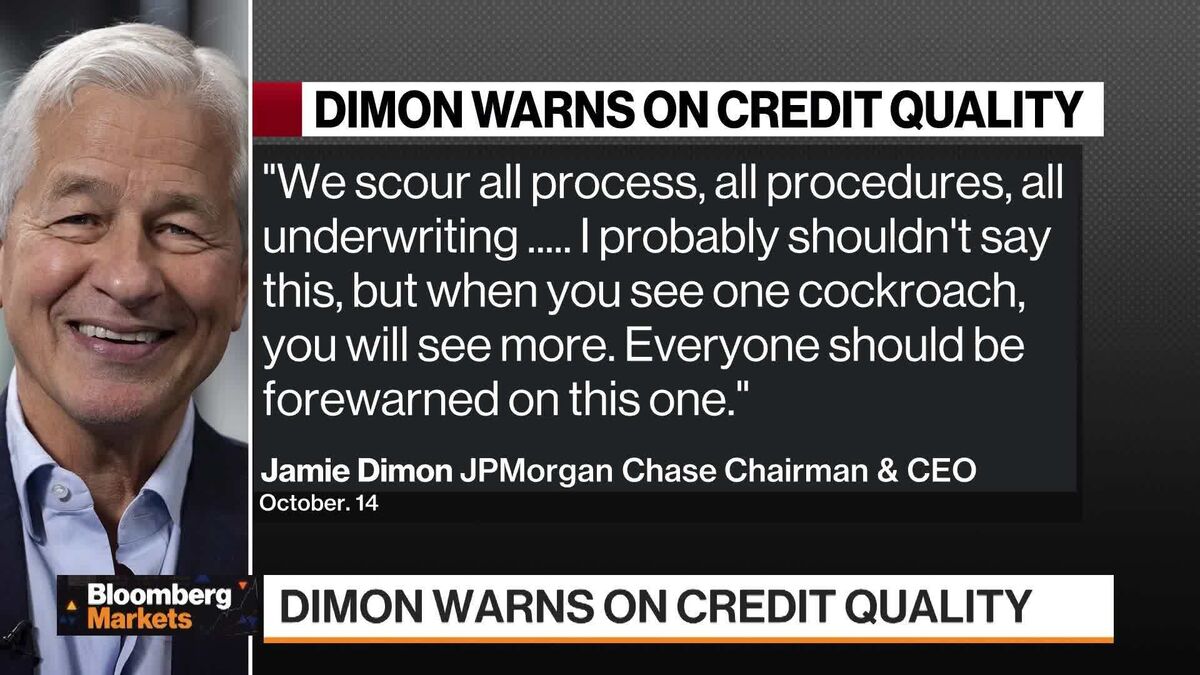

JPMorgan Chase has reported strong performance driven by increased dealmaking activities, yet CEO Jamie Dimon has cautioned about potential uncertainties in the financial markets ahead. This highlights the bank's resilience in navigating current economic challenges while also acknowledging the unpredictable nature of future market conditions, which is crucial for investors and stakeholders to consider.

— Curated by the World Pulse Now AI Editorial System