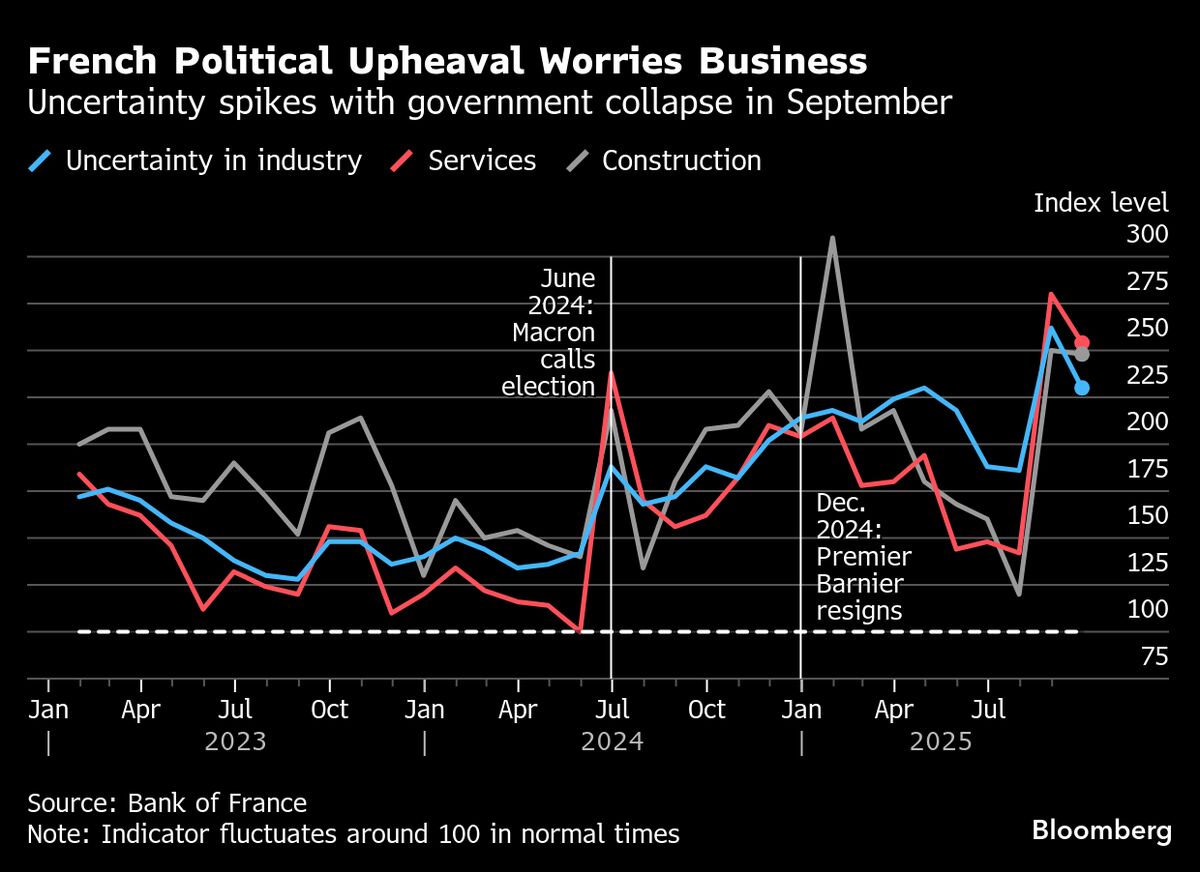

Macron searches for France’s sixth prime minister in under two years

NeutralFinancial Markets

French President Emmanuel Macron is on the hunt for his sixth prime minister in less than two years, highlighting the ongoing political instability in the country. This frequent turnover in leadership raises questions about the effectiveness of his administration and its ability to implement policies. As Macron navigates these challenges, the implications for France's governance and public trust are significant, making this search a critical moment in his presidency.

— Curated by the World Pulse Now AI Editorial System