Powell Has Backing for 2025 Rate Cuts and Then Things Get Cloudy

NeutralFinancial Markets

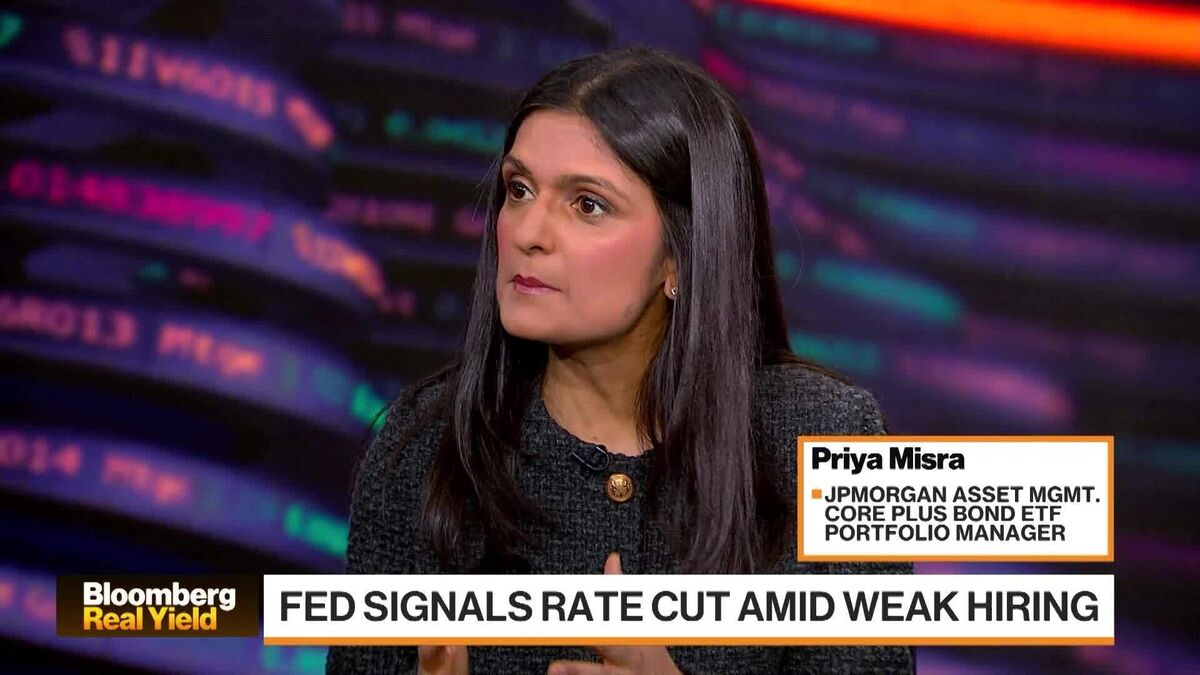

The Federal Reserve is poised to cut interest rates this month due to a weakening job market that currently outweighs concerns about inflation. However, this delicate balance may not last long, indicating potential shifts in economic policy ahead. Understanding these changes is crucial as they can impact borrowing costs and overall economic growth.

— Curated by the World Pulse Now AI Editorial System