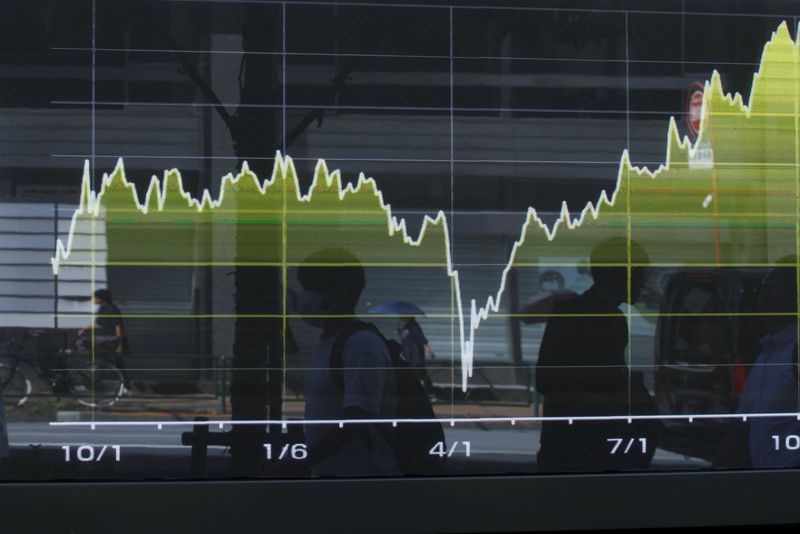

Asia stocks buoyed by tech gains, Japan at record high as rate hike bets unwind

PositiveFinancial Markets

Asian stocks are experiencing a significant boost, driven by gains in the technology sector, with Japan reaching a record high as investor concerns over interest rate hikes begin to ease. This positive trend reflects growing confidence in the market, suggesting that investors are optimistic about future economic growth and corporate performance. Such developments are crucial as they can influence global market dynamics and investor sentiment.

— Curated by the World Pulse Now AI Editorial System