Yen Carry Trade Is Back on Radar After Takaichi Jolts Markets

PositiveFinancial Markets

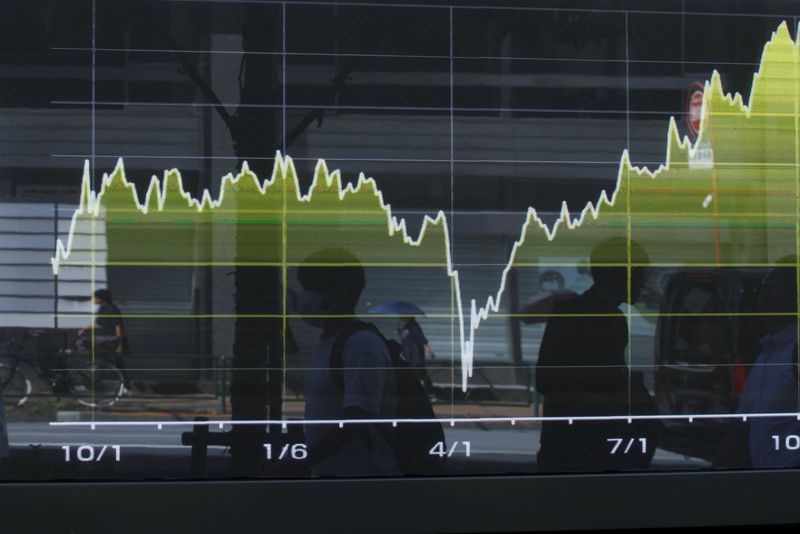

The yen carry trade, a strategy that had fallen out of favor, is gaining attention again as Sanae Takaichi is likely to become Japan's next prime minister. This shift could lead to slower interest rate hikes, making the trade more appealing. Investors are watching closely, as this could signal a new phase in currency trading and impact global markets.

— Curated by the World Pulse Now AI Editorial System