Bessent Says US ‘Not Putting Money’ in Argentina, Touts Swaps

NeutralFinancial Markets

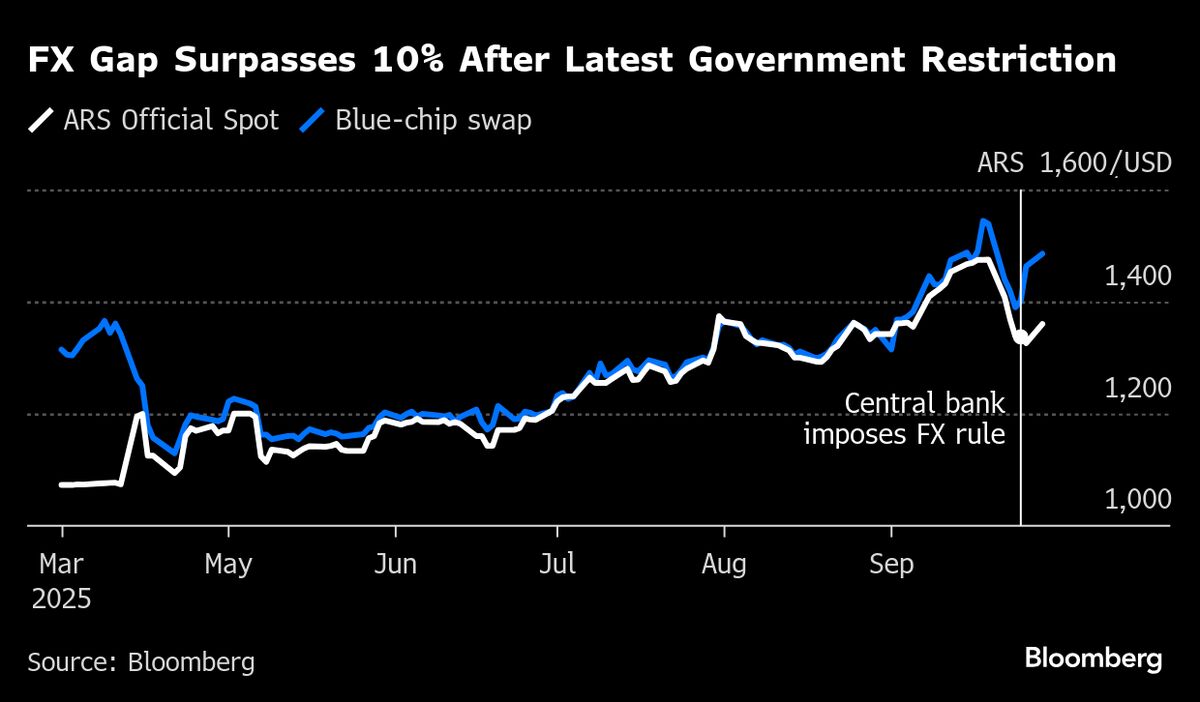

US Treasury Secretary Scott Bessent expressed support for Argentina's President Javier Milei, emphasizing that while the US backs the country, it does not involve direct financial investment. This statement comes amidst fluctuating bond markets, highlighting the complexities of international aid and investment. Understanding these dynamics is crucial as they can significantly impact Argentina's economic stability and investor confidence.

— Curated by the World Pulse Now AI Editorial System