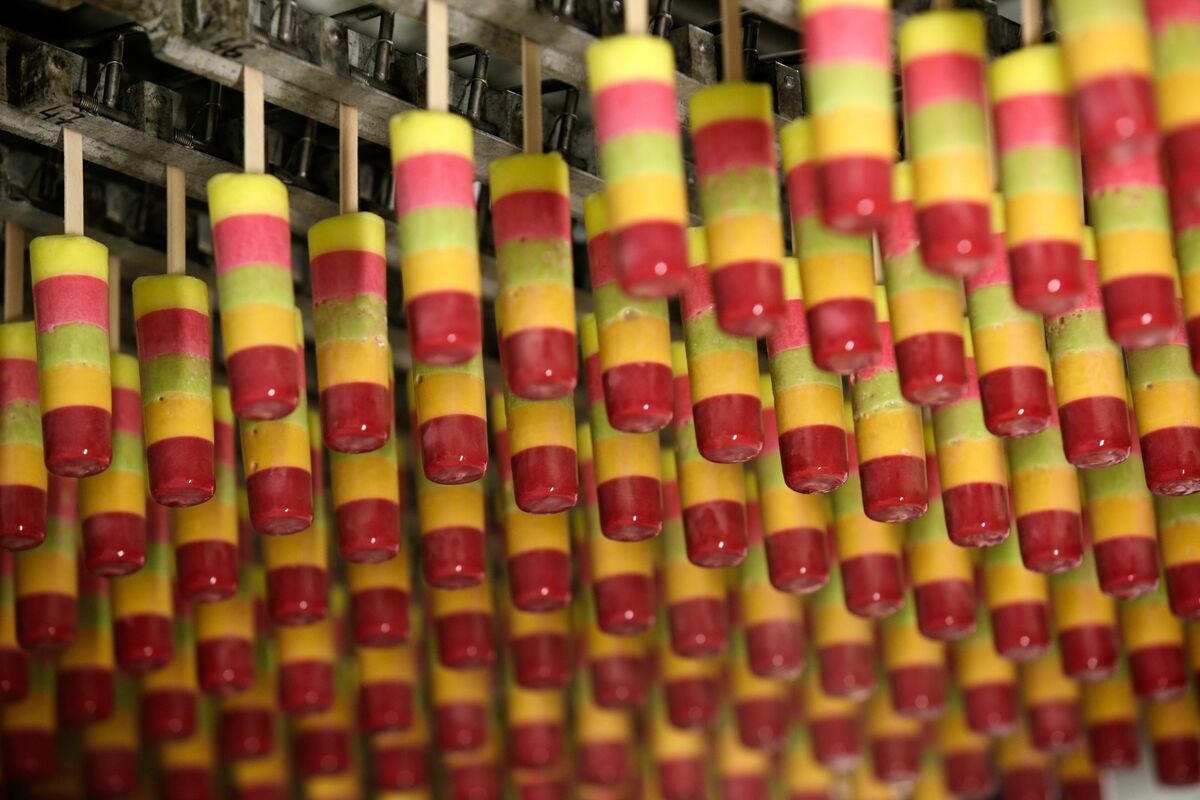

PAI Brings In Fresh Capital for €15 Billion Ice Cream Venture

PositiveFinancial Markets

PAI Partners is securing new funding for its ice cream venture with Nestle SA, which is expected to value the business at an impressive €15 billion, including debt. This move highlights the growing demand for ice cream and the potential for significant returns in the food industry, making it an exciting development for investors and consumers alike.

— Curated by the World Pulse Now AI Editorial System