Once the AI bubble pops, we’ll all suffer. Could that be better than letting it grow unabated?

NegativeFinancial Markets

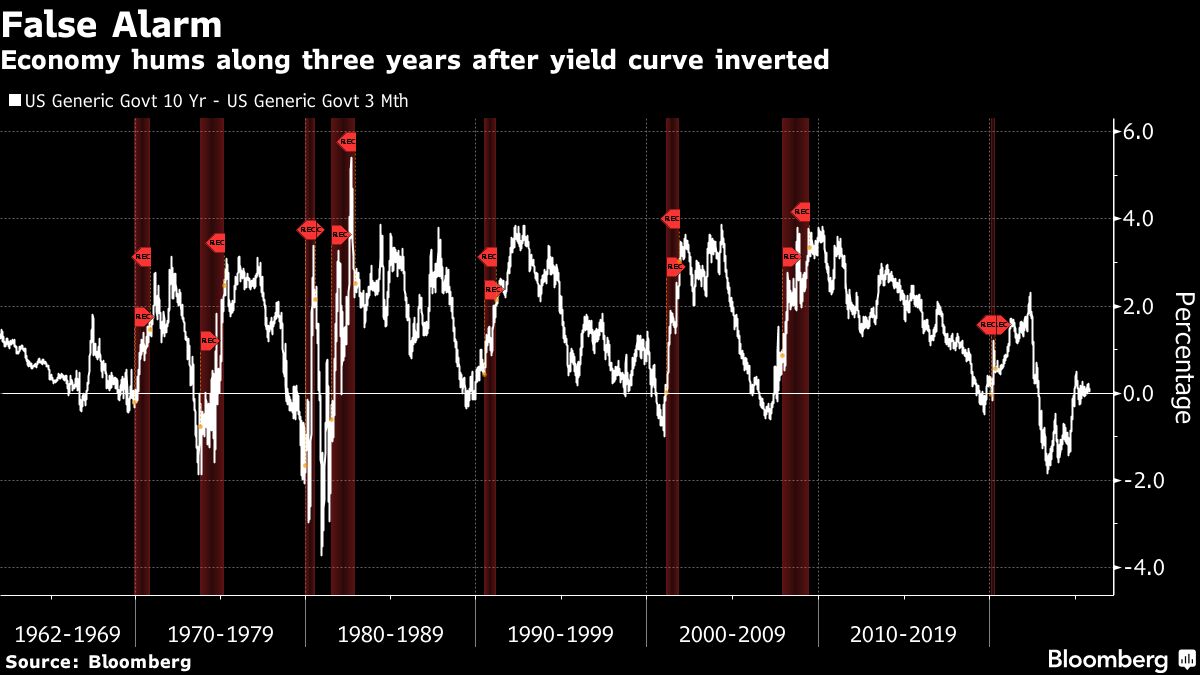

The article discusses the looming threat of a recession tied to the rise of artificial intelligence, suggesting that regardless of AI's success or failure, the consequences could be dire. It highlights the stagnation in employment growth and the slowdown in wage increases, particularly for low-paying jobs, indicating a troubling economic landscape. This matters because it raises concerns about the sustainability of the economy and the potential for widespread financial hardship as AI continues to evolve.

— Curated by the World Pulse Now AI Editorial System