JetBlue Slides As Fuel Costs, Weather Muddy Outlook

NegativeFinancial Markets

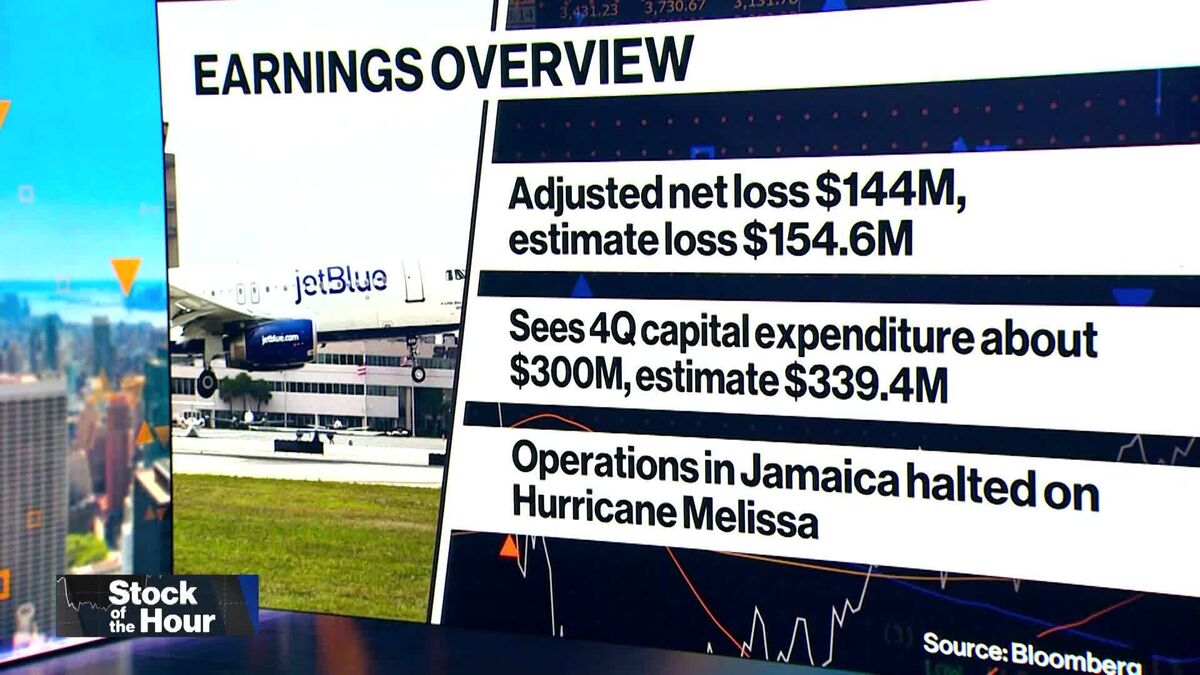

JetBlue's recent third-quarter results have led to a decline in its shares, as the airline reported a smaller-than-expected net loss. However, analysts are expressing concerns about the company's future outlook due to rising fuel costs and adverse weather conditions. This situation is significant as it highlights the ongoing challenges faced by airlines in maintaining profitability amidst fluctuating operational costs, which could impact investor confidence and the airline's market position.

— Curated by the World Pulse Now AI Editorial System