Asian Stocks Set to Drop After US Rally Falters: Markets Wrap

NegativeFinancial Markets

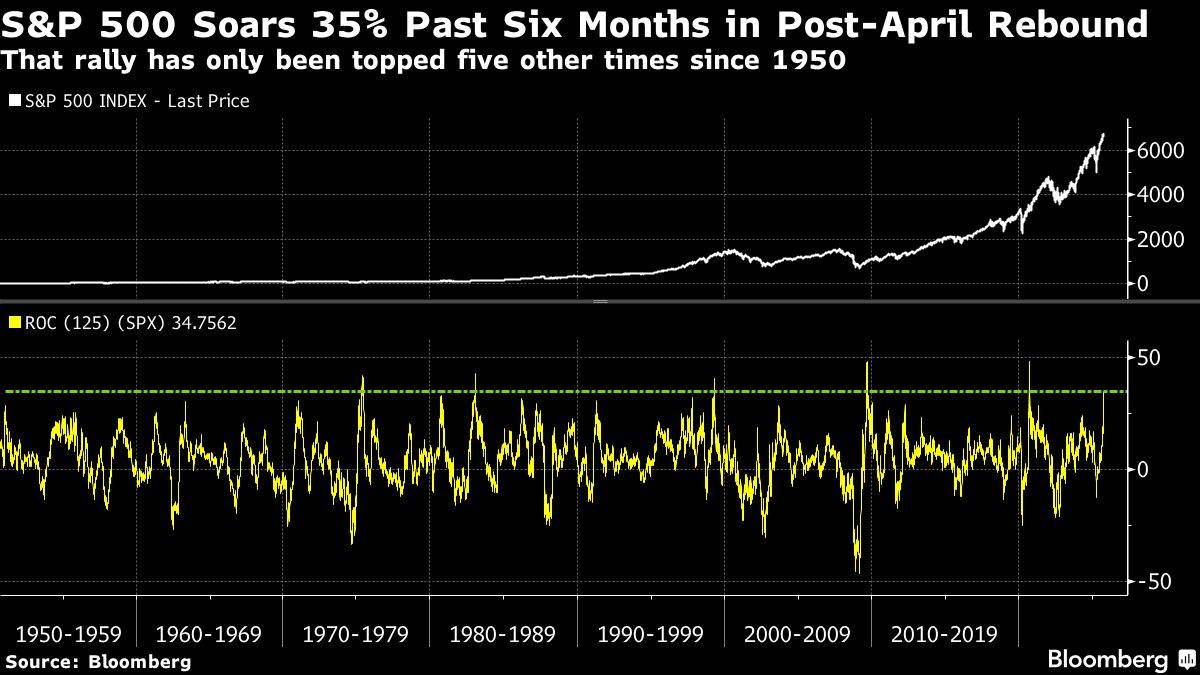

Asian stocks are expected to decline after a recent rally in US markets has lost momentum. Investors are worried that stock valuations may be too high following a significant surge, which could lead to a market correction. This matters because it reflects broader economic concerns and could impact global market stability.

— Curated by the World Pulse Now AI Editorial System