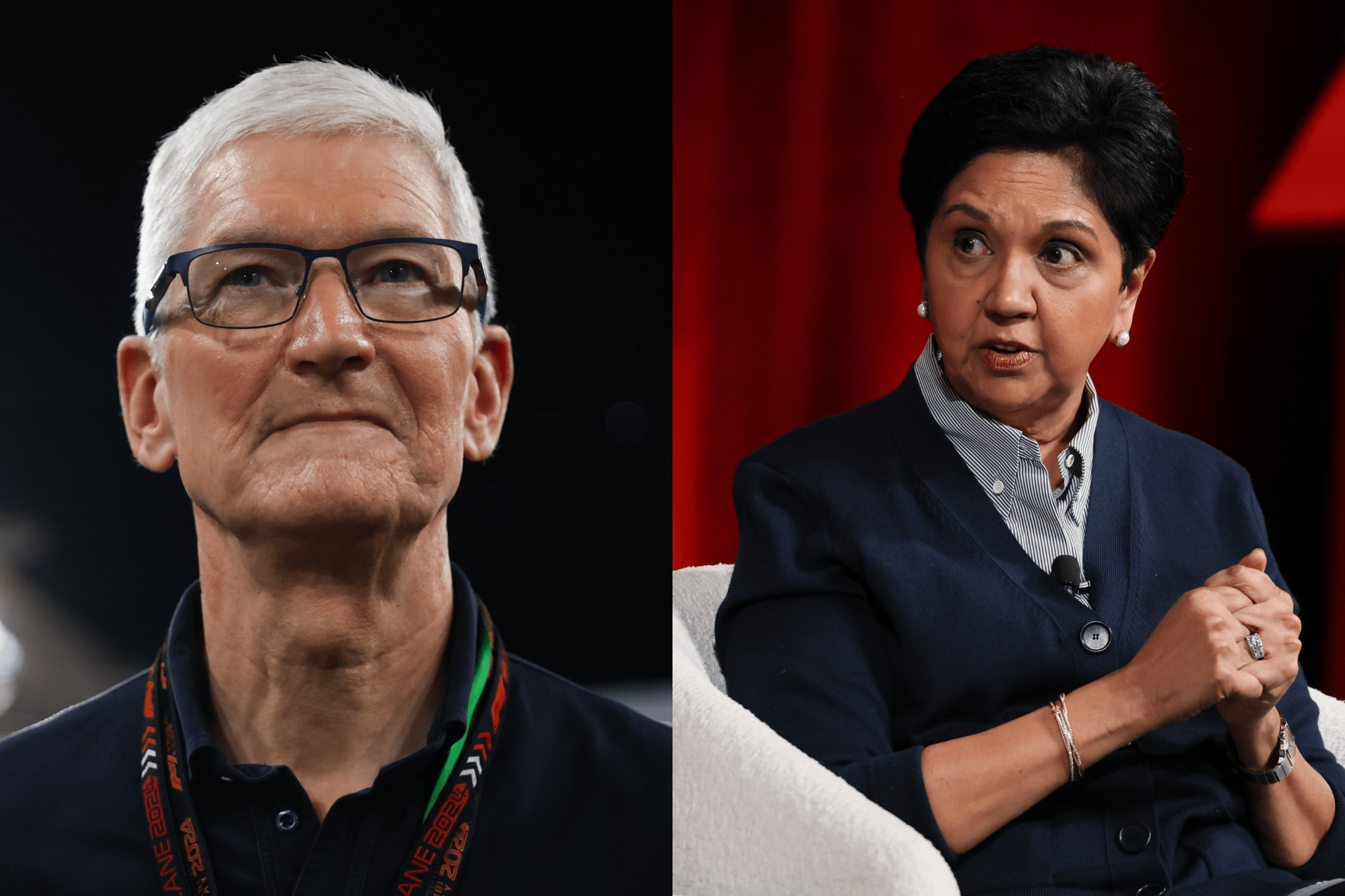

The CEOs of Apple, Airbnb, and PepsiCo agree on one thing: life as a business leader is incredibly lonely

NeutralFinancial Markets

In a recent discussion, CEOs from major companies like Apple, Airbnb, and PepsiCo highlighted the loneliness that often accompanies their high-stakes roles. Tim Cook and Brian Chesky emphasized the importance of connecting with peers to combat this isolation. This conversation sheds light on the mental health challenges faced by business leaders and underscores the need for support networks in the corporate world.

— Curated by the World Pulse Now AI Editorial System