Stock Futures Rise but Dollar Falls as Lawmakers Race to Avoid Shutdown

PositiveFinancial Markets

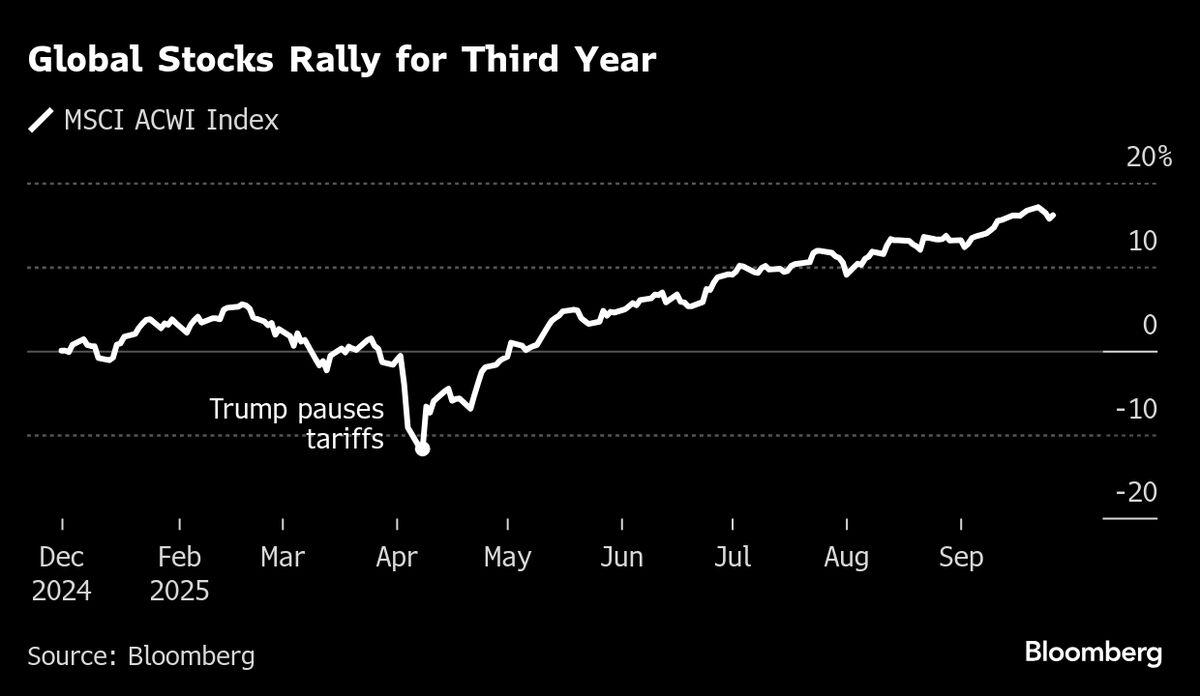

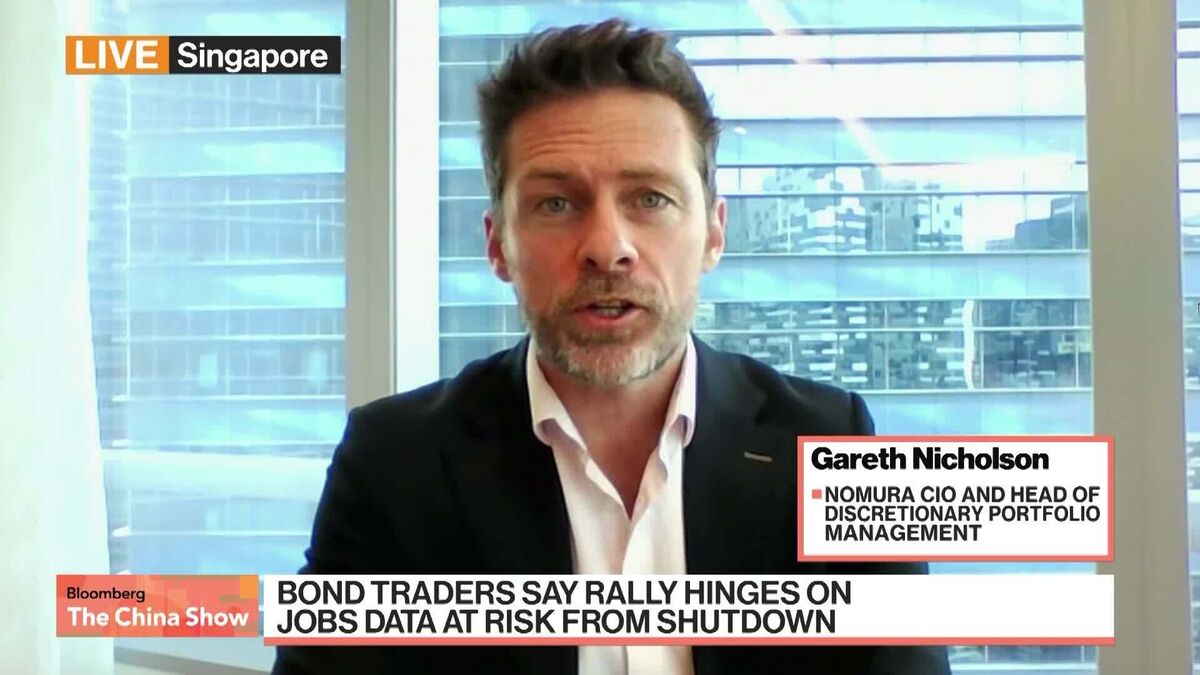

Stock futures are on the rise, fueled by optimism surrounding big tech companies and the anticipation of potential rate cuts from the Federal Reserve. This positive momentum in the stock market is significant as it reflects investor confidence and could lead to further economic growth, especially if lawmakers successfully avoid a government shutdown.

— Curated by the World Pulse Now AI Editorial System