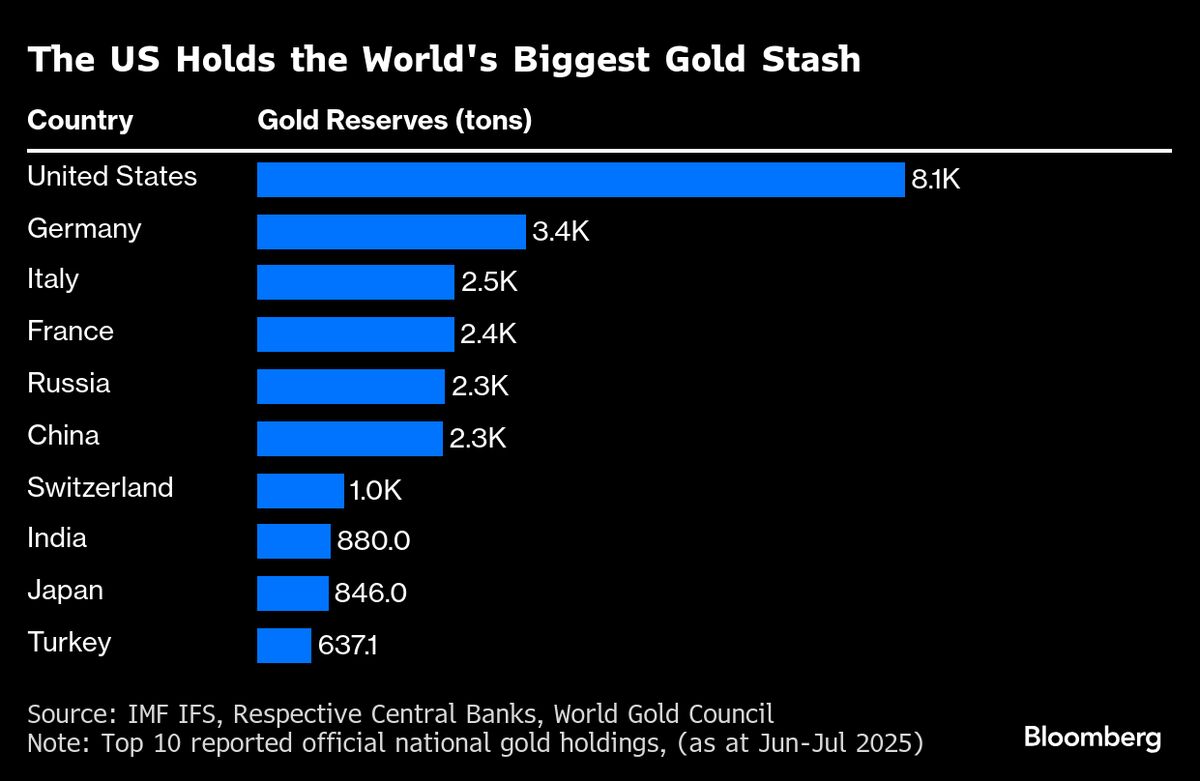

US Gold Reserves Hit $1 Trillion in Value After Record Rally

PositiveFinancial Markets

The US Treasury's gold reserves have reached a remarkable milestone, surpassing $1 trillion in value, which is over 90 times the amount recorded on the government's balance sheet. This surge comes as gold prices hit new all-time highs, reflecting the precious metal's growing importance as a safe-haven asset. This development is significant as it highlights the strength of the US economy and the increasing demand for gold amidst global uncertainties.

— Curated by the World Pulse Now AI Editorial System