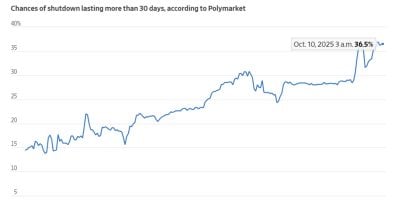

Polymarket traders bet on government shutdown lasting through October

NegativeCryptocurrency

Traders on Polymarket are betting that the government shutdown will extend through October, reflecting growing political divides and concerns over economic impacts. This situation is significant as it not only affects public trust in government but also threatens essential services that citizens rely on. The uncertainty surrounding the shutdown could lead to broader economic disruptions, making it a critical issue to watch.

— Curated by the World Pulse Now AI Editorial System

![Best Crypto Exchanges to Trade in October 2025 [Updated Rankings & Key Trends]](https://static.news.bitcoin.com/wp-content/uploads/2025/10/best-crypto-exchanges-october-2025-768x432.png)