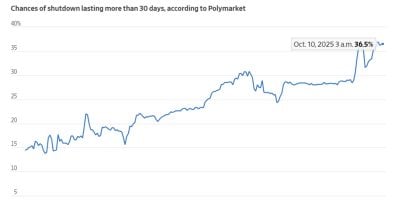

Asia Morning Briefing: Polymarket’s POLY Could Bring Oracle's Home

PositiveCryptocurrency

In today's Asia Morning Briefing, we explore how Polymarket's POLY token could potentially enhance Oracle's capabilities in the blockchain space. This development is significant as it highlights the growing intersection of decentralized finance and traditional data services, paving the way for innovative solutions in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System