NYSE Lists Solana, Hedera, Litecoin Spot Crypto ETFs for Trading This Week

PositiveCryptocurrency

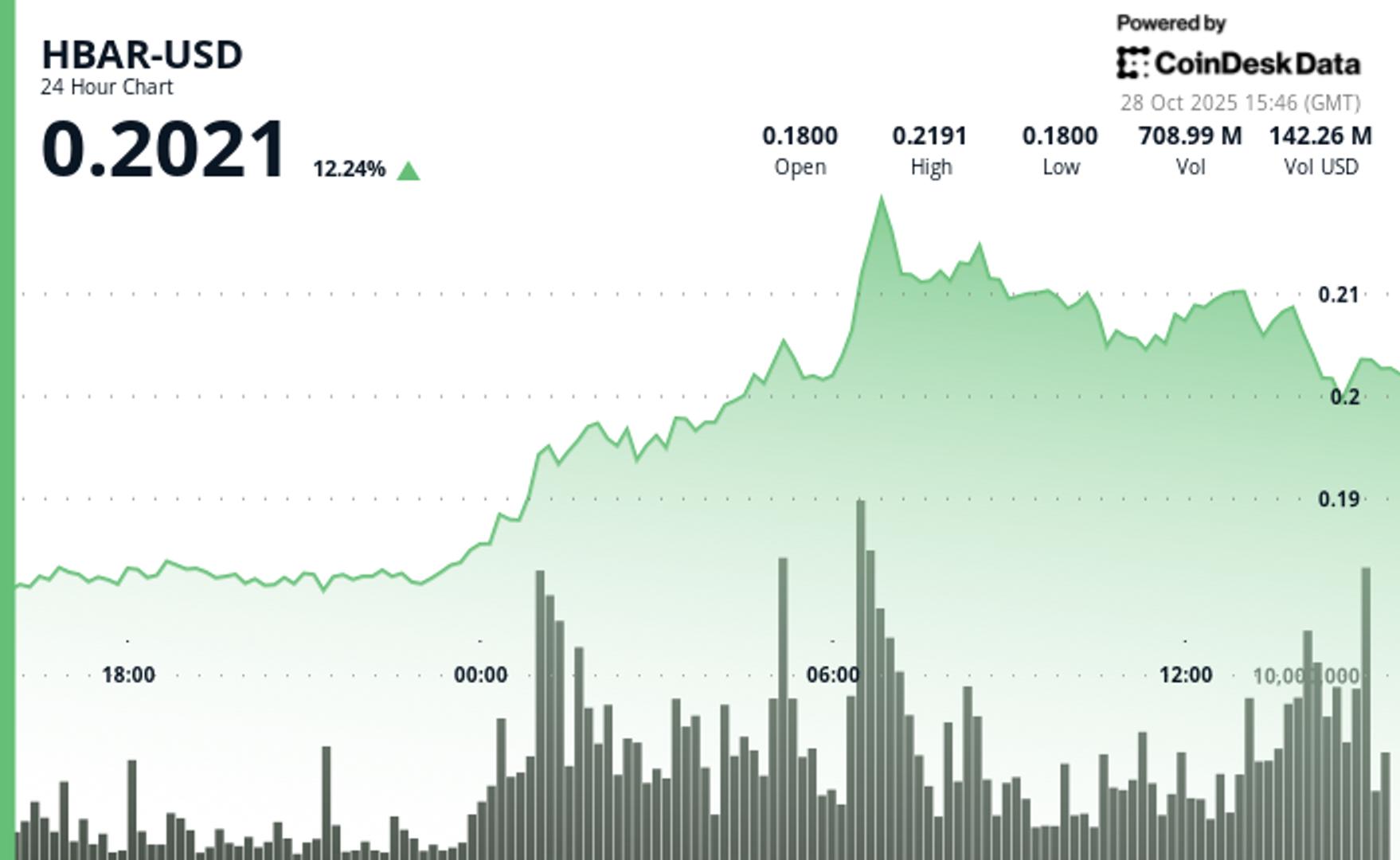

The NYSE is making waves by listing four new spot crypto ETFs, including Solana, Hedera, and Litecoin, for trading this week. This move comes even as the SEC staff continues to process approvals amidst a government shutdown, highlighting a growing acceptance of cryptocurrency in mainstream finance. The introduction of these ETFs is significant as it provides investors with more options to engage with digital assets, potentially increasing market participation and stability.

— Curated by the World Pulse Now AI Editorial System