Canary Capital’s CEO Confirms Spot Hedera And Litecoin ETFs Will Begin Trading Tomorrow

PositiveCryptocurrency

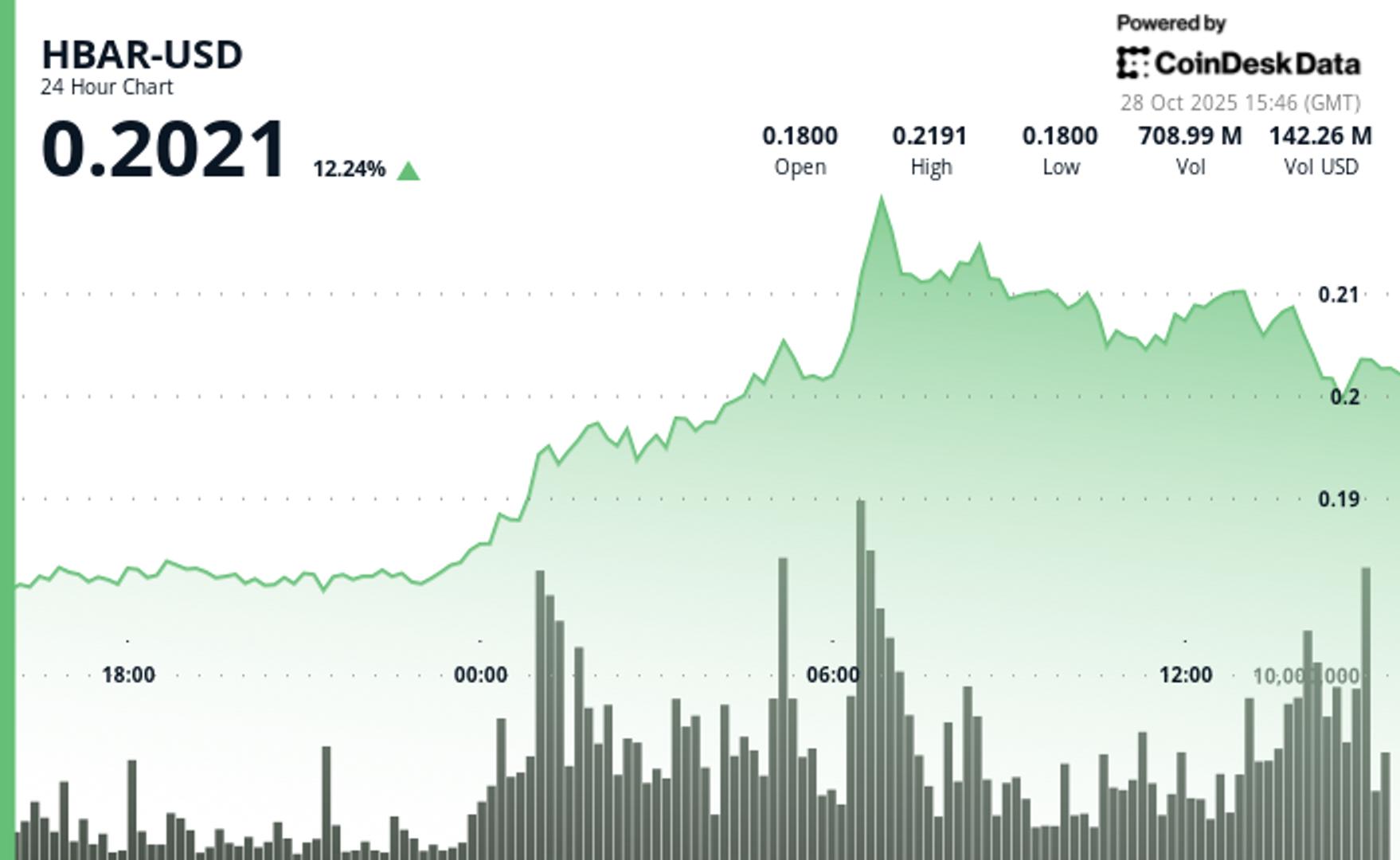

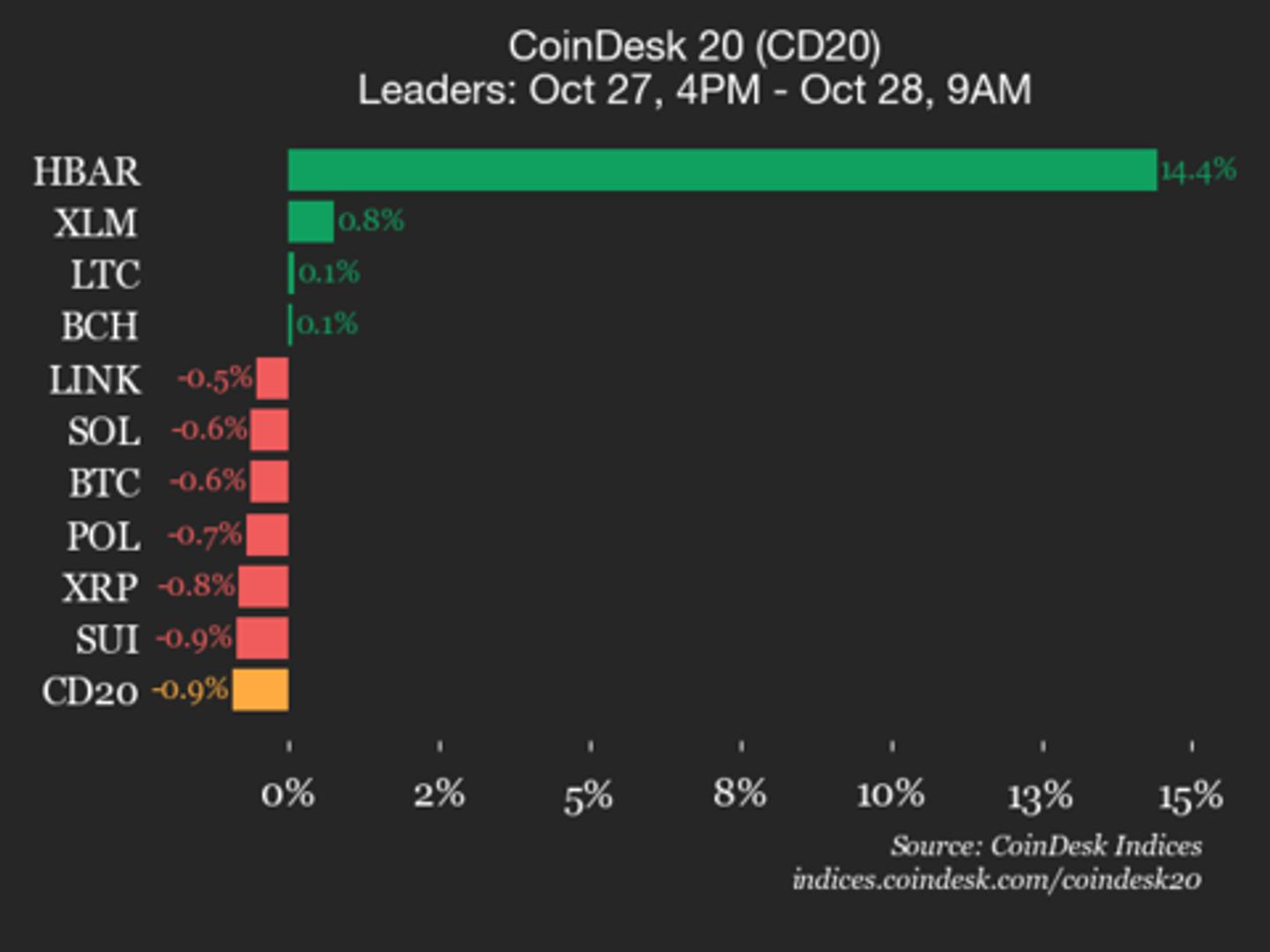

Excitement is building as Canary Capital's CEO, Steven McClurg, has confirmed that the long-awaited exchange-traded funds (ETFs) for Hedera and Litecoin will begin trading tomorrow. This news comes after months of anticipation in the crypto community, highlighting a significant step forward for these digital assets. The launch of these ETFs is expected to attract more investors and increase the legitimacy of cryptocurrencies in the financial market.

— Curated by the World Pulse Now AI Editorial System