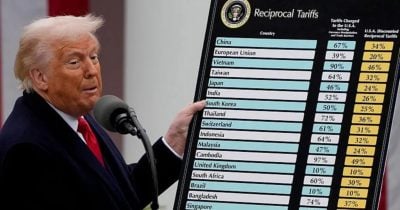

Trump proposes massive tariff increase on Chinese imports

NegativeCryptocurrency

Trump's recent proposal to significantly increase tariffs on Chinese imports could lead to further disruptions in global supply chains, particularly affecting industries that depend on rare earth elements. This move not only heightens tensions between the US and China but also raises concerns about the potential economic fallout for businesses and consumers alike.

— Curated by the World Pulse Now AI Editorial System