ChainLink Jumps 14% as Whales Accumulate $116M Worth of LINK Tokens Since Crash

PositiveCryptocurrency

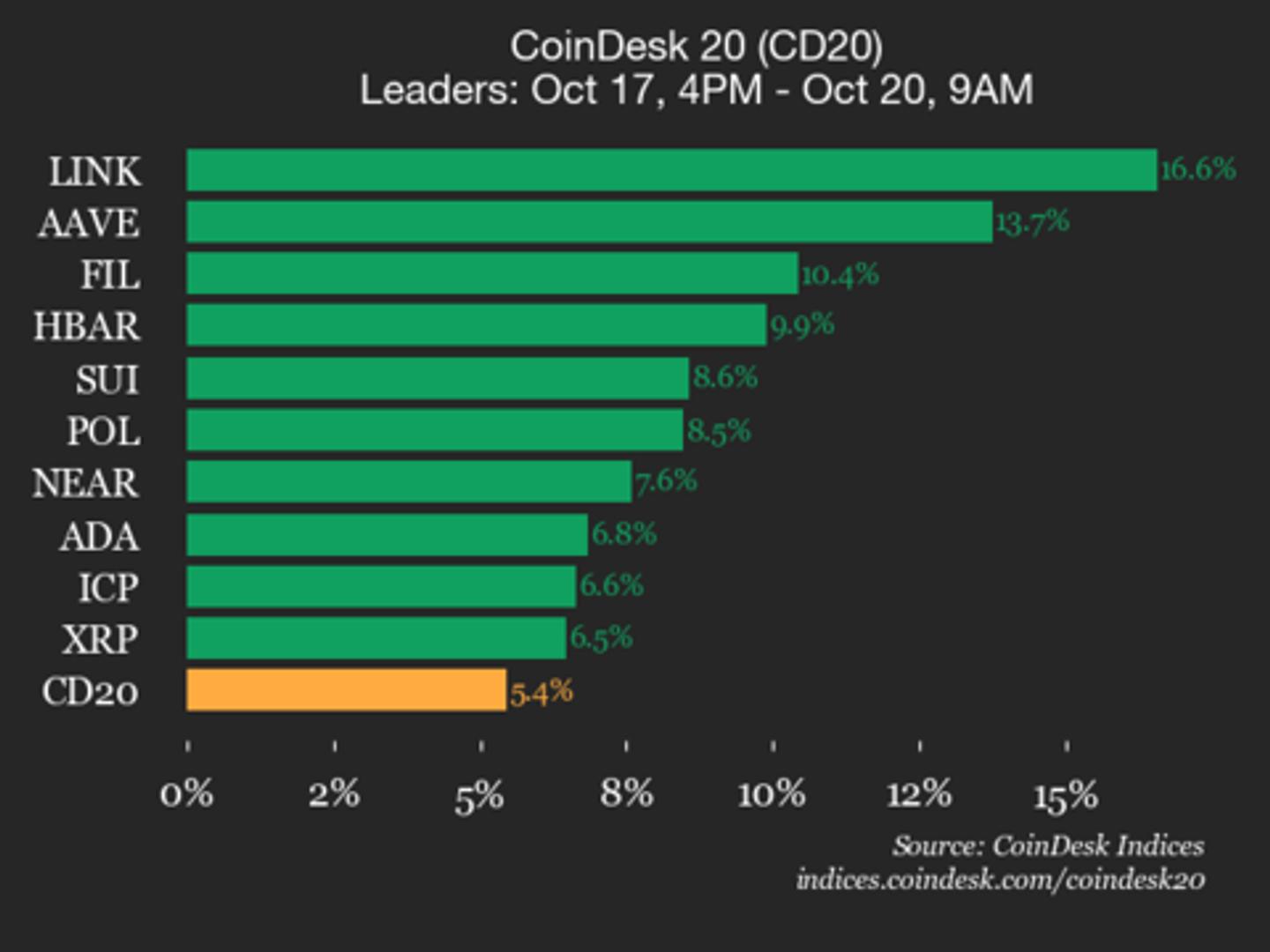

ChainLink has seen a remarkable 14% increase in value as significant investors, often referred to as 'whales', have accumulated $116 million worth of LINK tokens following a recent market crash. This surge is fueled by new institutional partnerships and Chainlink Labs' efforts to expand into real-world asset infrastructure, highlighting the growing confidence in the token's potential and its applications in the blockchain space.

— Curated by the World Pulse Now AI Editorial System