Musk's Tesla Teases Product Unveiling for Oct. 7

PositiveFinancial Markets

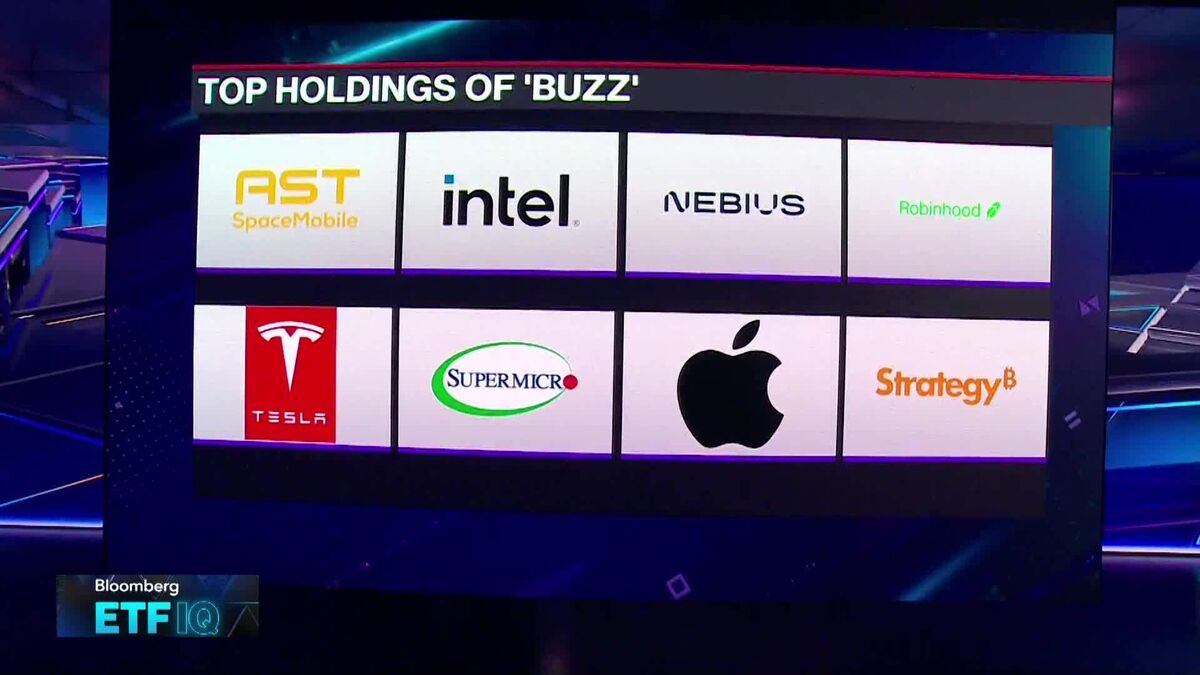

Tesla is generating excitement with a mysterious teaser for a product unveiling on October 7th, sparking speculation among investors about what Elon Musk might reveal. The buzz has already led to a jump in Tesla's stock price, indicating strong market interest. Bloomberg's Craig Trudell discussed the clues surrounding this announcement, highlighting its potential significance for Tesla's future innovations. This event could mark a pivotal moment for the company, showcasing its commitment to cutting-edge technology and maintaining investor confidence.

— Curated by the World Pulse Now AI Editorial System