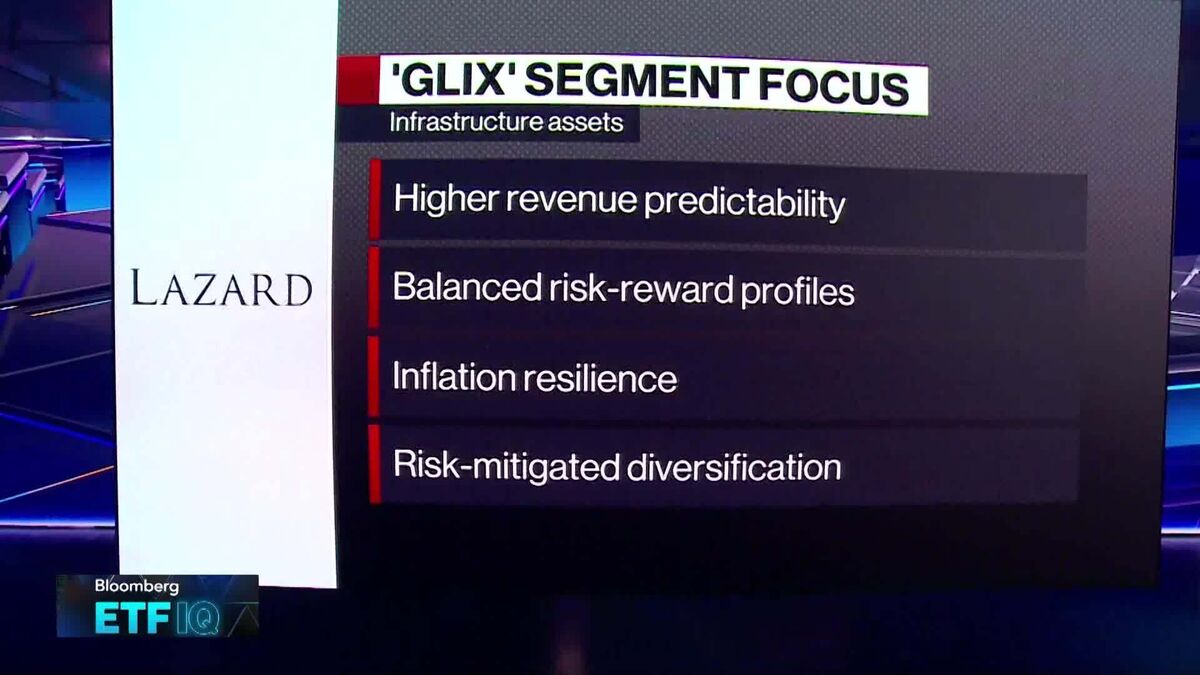

Lazard Listed Infrastructure ETF Launches

PositiveFinancial Markets

Lazard Asset Management has just launched the Lazard Listed Infrastructure ETF, known by its ticker GLIX. This move is significant as it reflects the growing interest in infrastructure investments, which can provide stability and potential growth in uncertain economic times. Robert Forsyth, the global head of ETFs at Lazard, shared insights on this launch during a discussion with Bloomberg's Scarlet Fu, Katie Greifeld, and Eric Balchunas, highlighting the importance of this new financial product in today's market.

— Curated by the World Pulse Now AI Editorial System