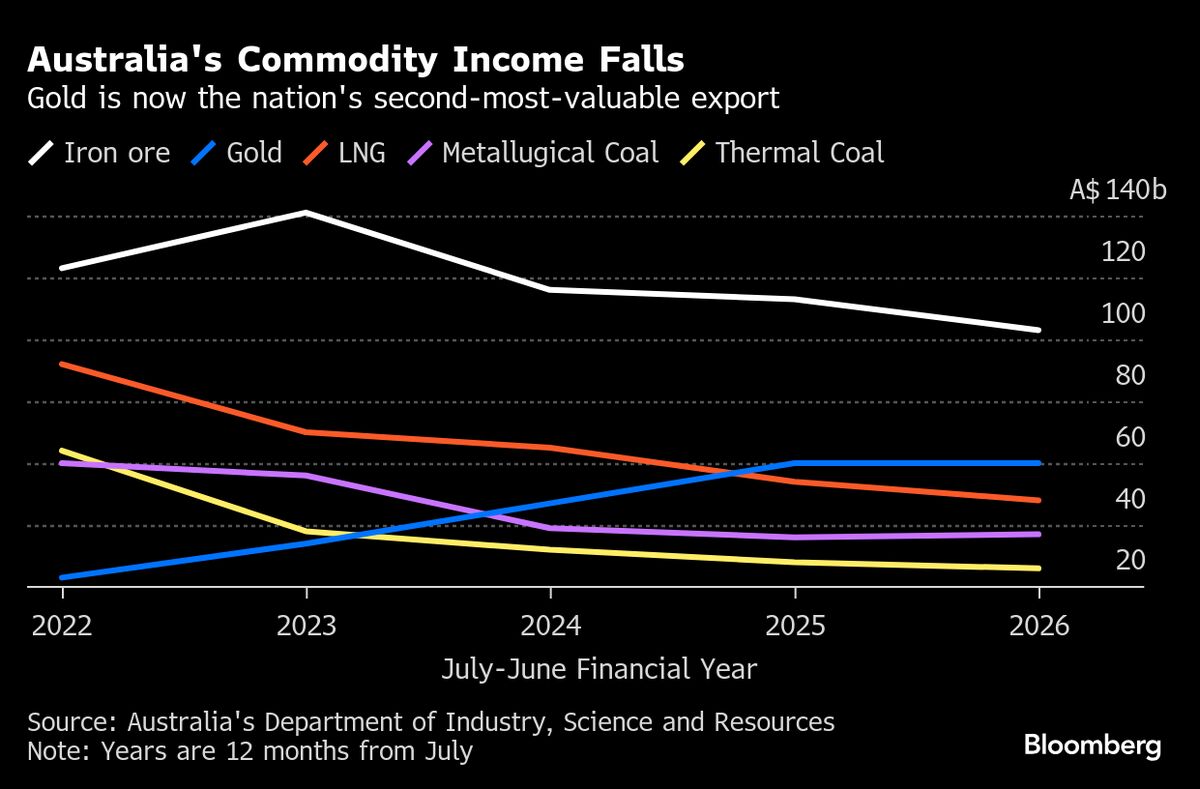

Gas-Turbine Crunch Threatens Demand Bonanza in Asia

NegativeFinancial Markets

The gas-turbine crunch in Asia is causing significant delays, with wait-times for certain models extending to the end of the decade. This situation poses challenges for LNG shippers looking to meet the growing demand in the region. As energy needs rise, the inability to secure timely equipment could hinder supply chains and impact energy prices, making it a critical issue for both suppliers and consumers.

— Curated by the World Pulse Now AI Editorial System