Economy, Markets Resilient to Shutdown Risks: JPMorgan

PositiveFinancial Markets

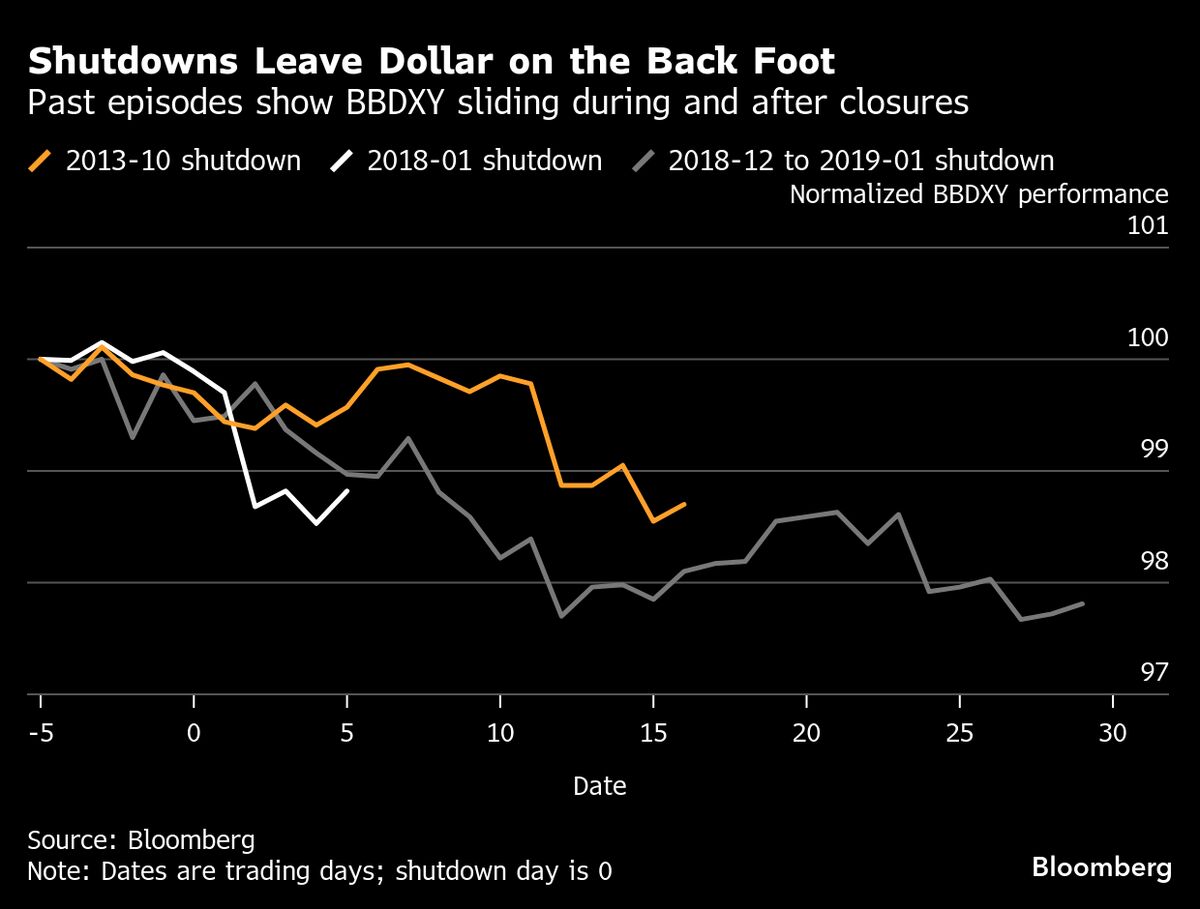

JPMorgan's investment strategist Madison Faller has expressed confidence in the resilience of the US economy and markets despite the looming risks of a government shutdown. In a recent interview on Bloomberg Television, Faller emphasized the underlying strength that continues to support economic stability. This perspective is crucial as it reassures investors and stakeholders about the market's ability to withstand potential disruptions, highlighting the importance of maintaining a positive outlook during uncertain times.

— Curated by the World Pulse Now AI Editorial System