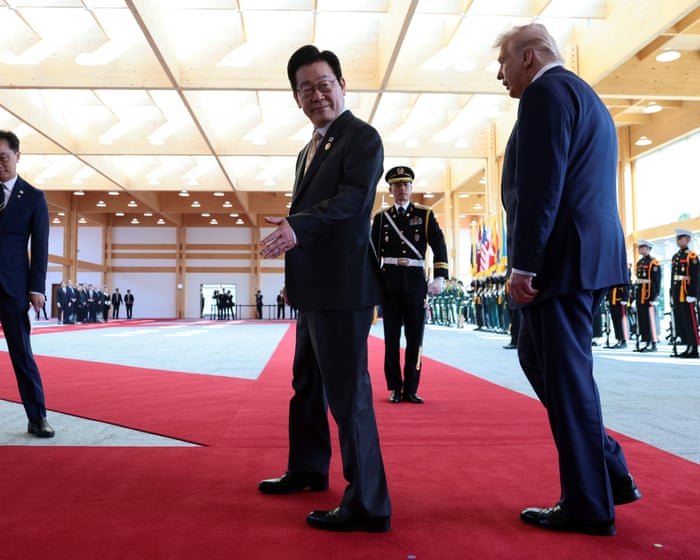

Trump says he will cut fentanyl tariffs on China

PositiveFinancial Markets

President Trump has announced plans to cut tariffs on fentanyl imports from China during his visit to South Korea, where he is engaging in discussions on trade and security. This move is significant as it aims to strengthen trade relations and address the ongoing opioid crisis in the U.S. by making essential medications more accessible. The upcoming summit with Xi Jinping adds further importance to these negotiations, highlighting the delicate balance between trade and health.

— Curated by the World Pulse Now AI Editorial System