AtkinsRéalis' Véronneau on Modernizing Infrastructure

PositiveFinancial Markets

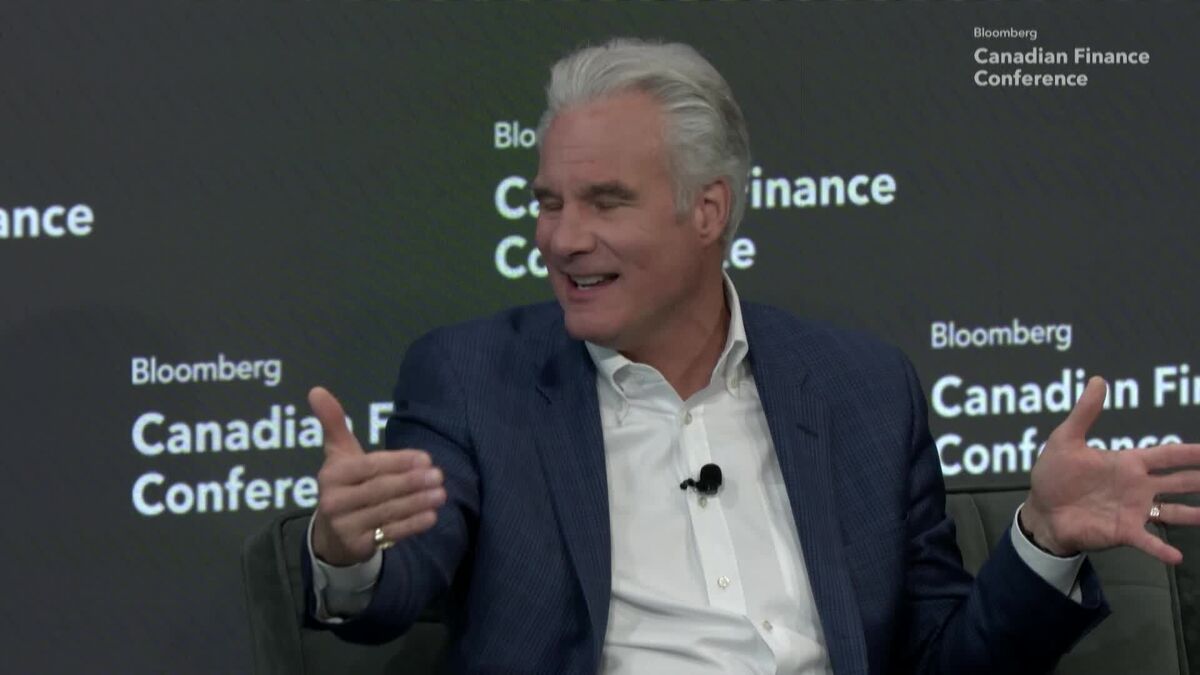

Louis G. Véronneau, the COO of AtkinsRéalis, recently shared insights on the importance of modernizing infrastructure to address current and future needs during an interview with Bloomberg's Derek DeCloet at the 2025 Bloomberg Canadian Finance Conference in New York. This discussion is crucial as it highlights the ongoing efforts to enhance infrastructure, which is vital for economic growth and sustainability.

— Curated by the World Pulse Now AI Editorial System