Ares Collects $5.3 Billion for Infrastructure Secondaries Deals

PositiveFinancial Markets

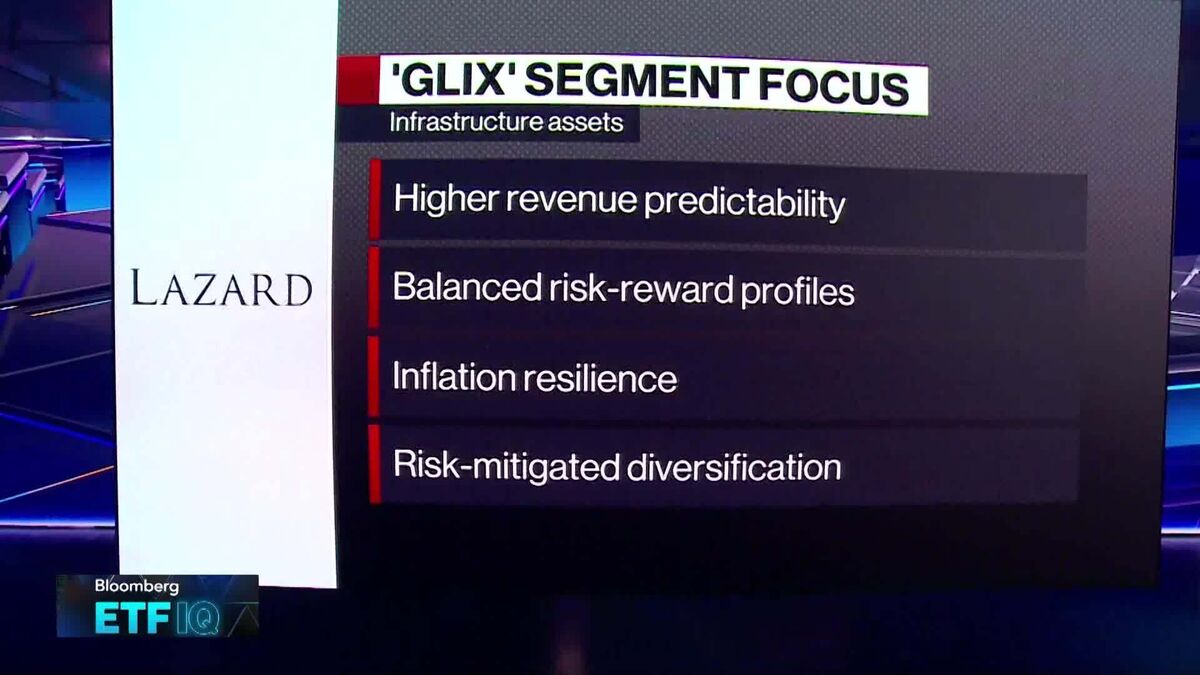

Ares Management Corp. has successfully raised $5.3 billion to support infrastructure secondaries deals, reflecting a growing investor appetite for these types of assets. This significant capital influx not only highlights the increasing interest in infrastructure investments but also positions Ares as a key player in the market, potentially leading to more robust economic growth and development in the sector.

— Curated by the World Pulse Now AI Editorial System