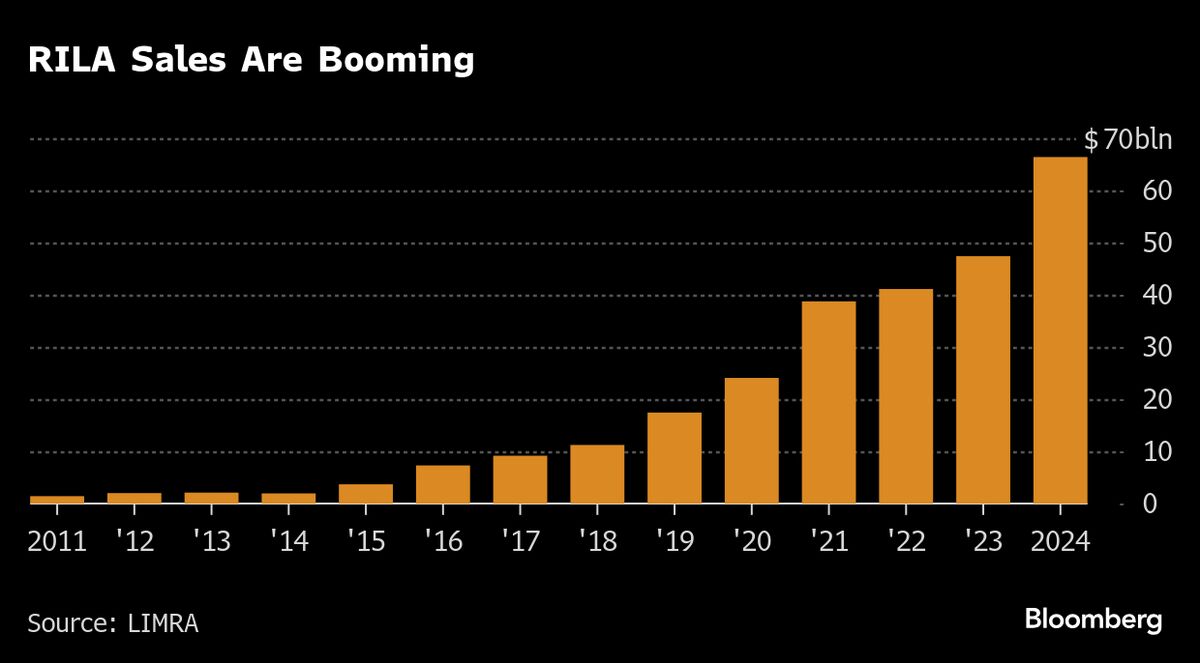

Distortions Hit Equity Funding, Dividend Curve as ‘RILAs’ Boom

NeutralFinancial Markets

Recent developments in the US equity market reveal distortions in equity funding and the dividend curve, largely driven by the rise of RILAs, or registered index-linked annuities. This trend highlights Wall Street's growing focus on derivatives-powered products, which are reshaping how investors approach the market. Understanding these changes is crucial for investors as they navigate a landscape increasingly influenced by complex financial instruments.

— Curated by the World Pulse Now AI Editorial System