Morgan Stanley lays out shock case for the S&P 500

NegativeFinancial Markets

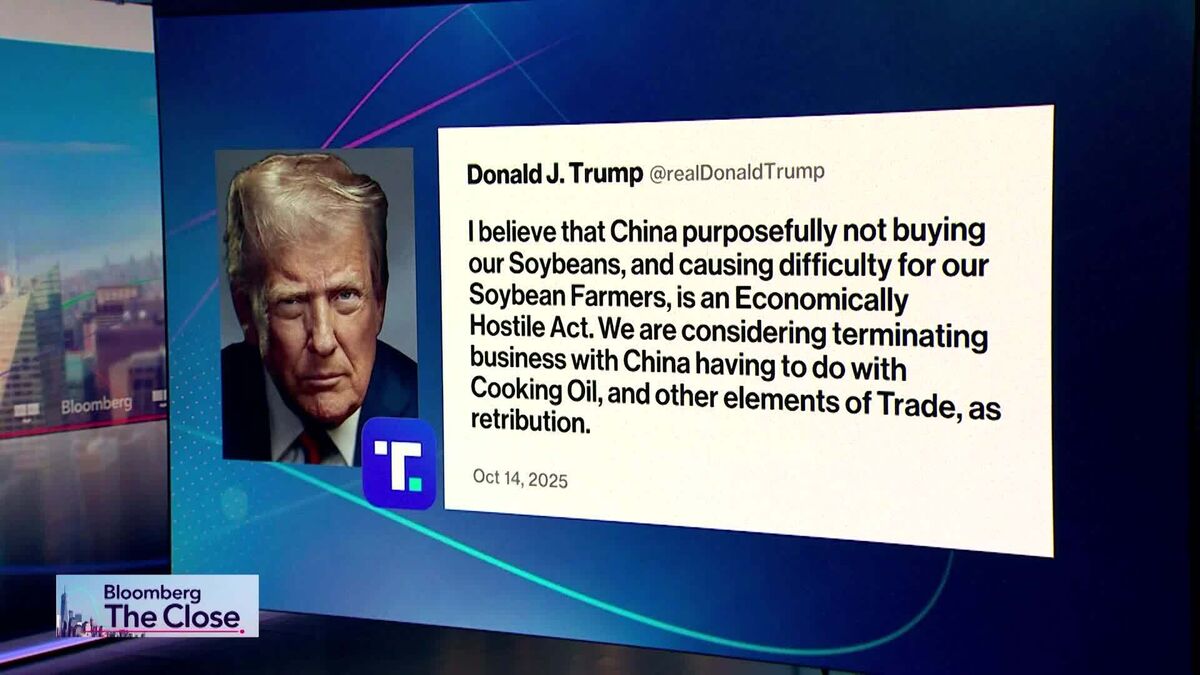

Morgan Stanley has issued a stark warning about the S&P 500, highlighting the vulnerability of the current market optimism. The recent sell-off on Wall Street serves as a reminder of how quickly sentiment can shift, particularly when political tensions and policy decisions come into play. This matters because it underscores the need for investors to remain cautious and aware of the potential risks that could impact their portfolios.

— Curated by the World Pulse Now AI Editorial System