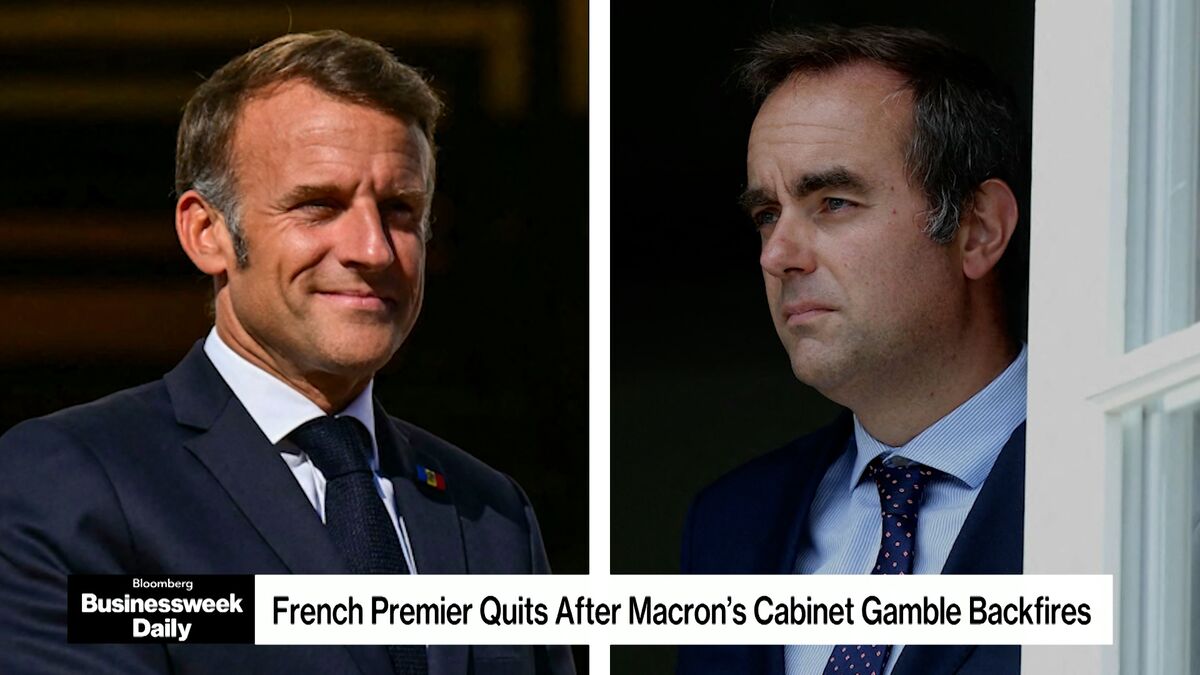

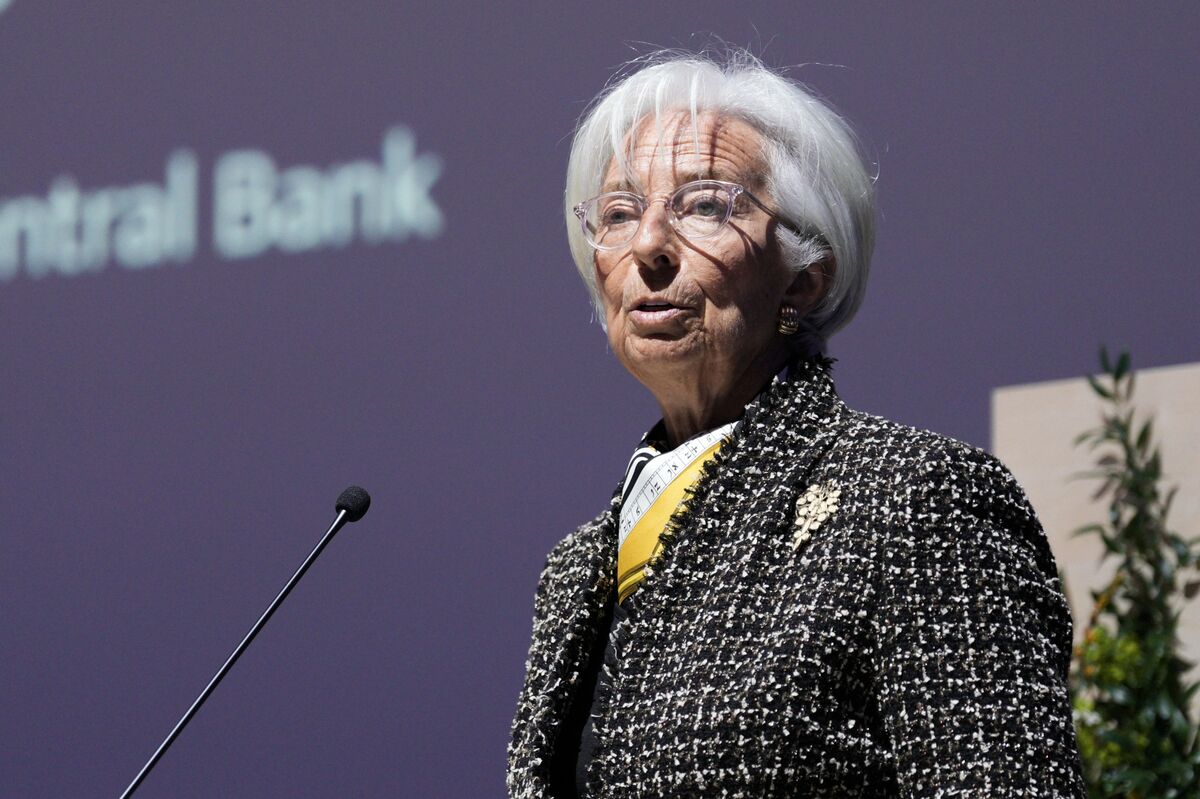

France’s political paralysis sparks fresh credit rating warnings

NegativeFinancial Markets

France is facing fresh warnings about its credit rating due to ongoing political paralysis, which is raising concerns among investors. This situation matters because a lower credit rating could lead to higher borrowing costs for the government and impact the overall economy, making it harder for France to recover from economic challenges.

— Curated by the World Pulse Now AI Editorial System