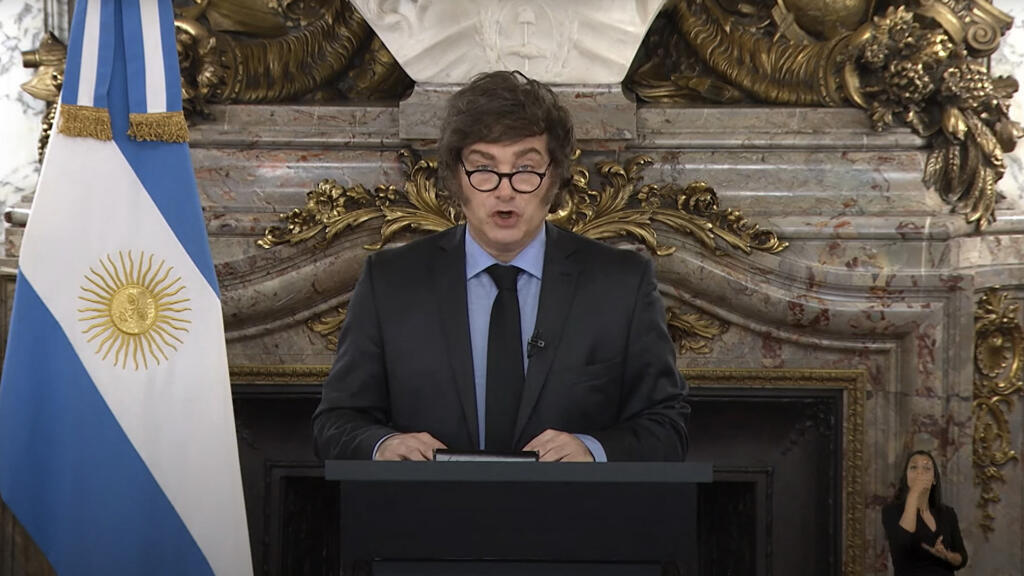

Sur Energy and OpenAI sign $25 billion data center deal in Argentina

PositiveFinancial Markets

Sur Energy and OpenAI have announced a groundbreaking $25 billion deal to establish a data center in Argentina. This partnership is significant as it not only boosts local employment and technological infrastructure but also positions Argentina as a key player in the global tech landscape. The investment is expected to enhance data processing capabilities and foster innovation in the region.

— Curated by the World Pulse Now AI Editorial System