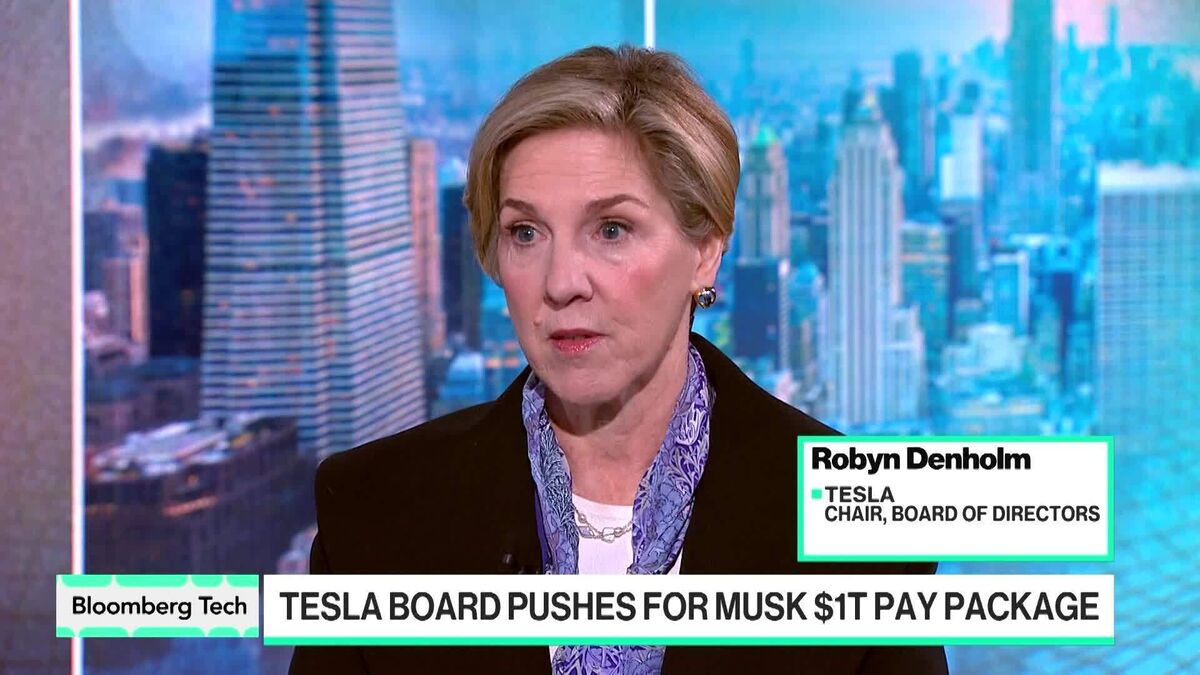

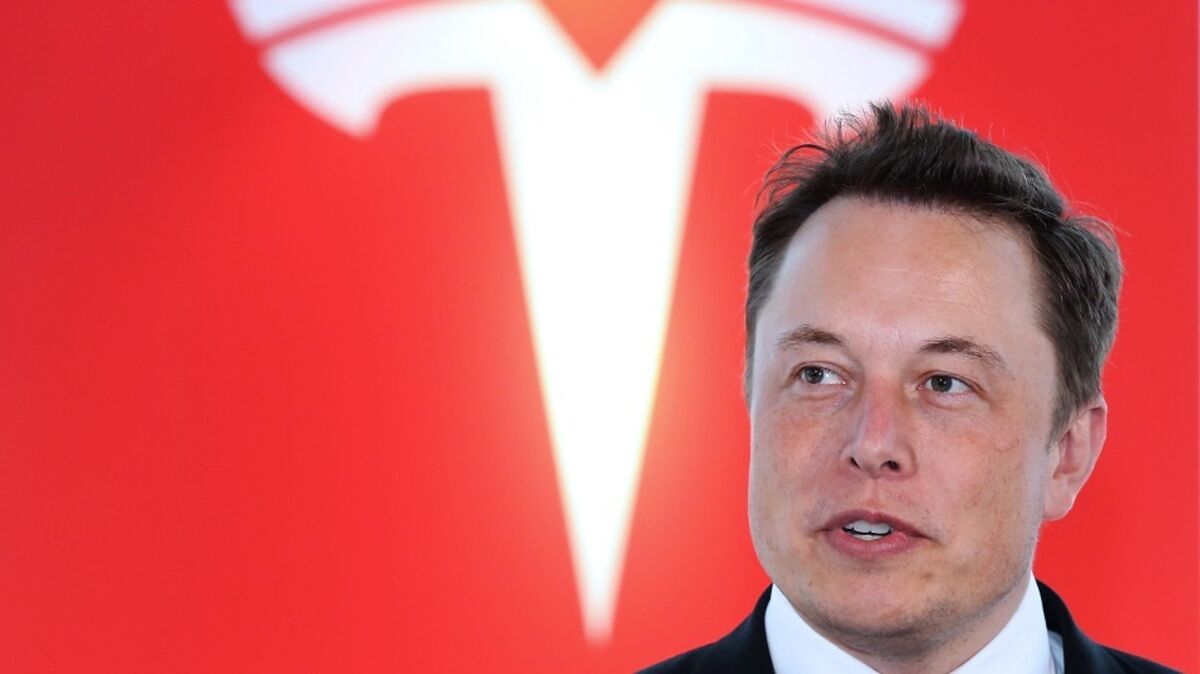

Tesla eyes internal CEO candidates if Musk steps down over pay vote, Bloomberg News reports

NeutralFinancial Markets

Tesla is reportedly considering internal candidates for the CEO position if Elon Musk decides to step down following a pay vote. This situation highlights the ongoing discussions around executive compensation and leadership stability within the company, which could impact Tesla's future direction and investor confidence.

— Curated by the World Pulse Now AI Editorial System