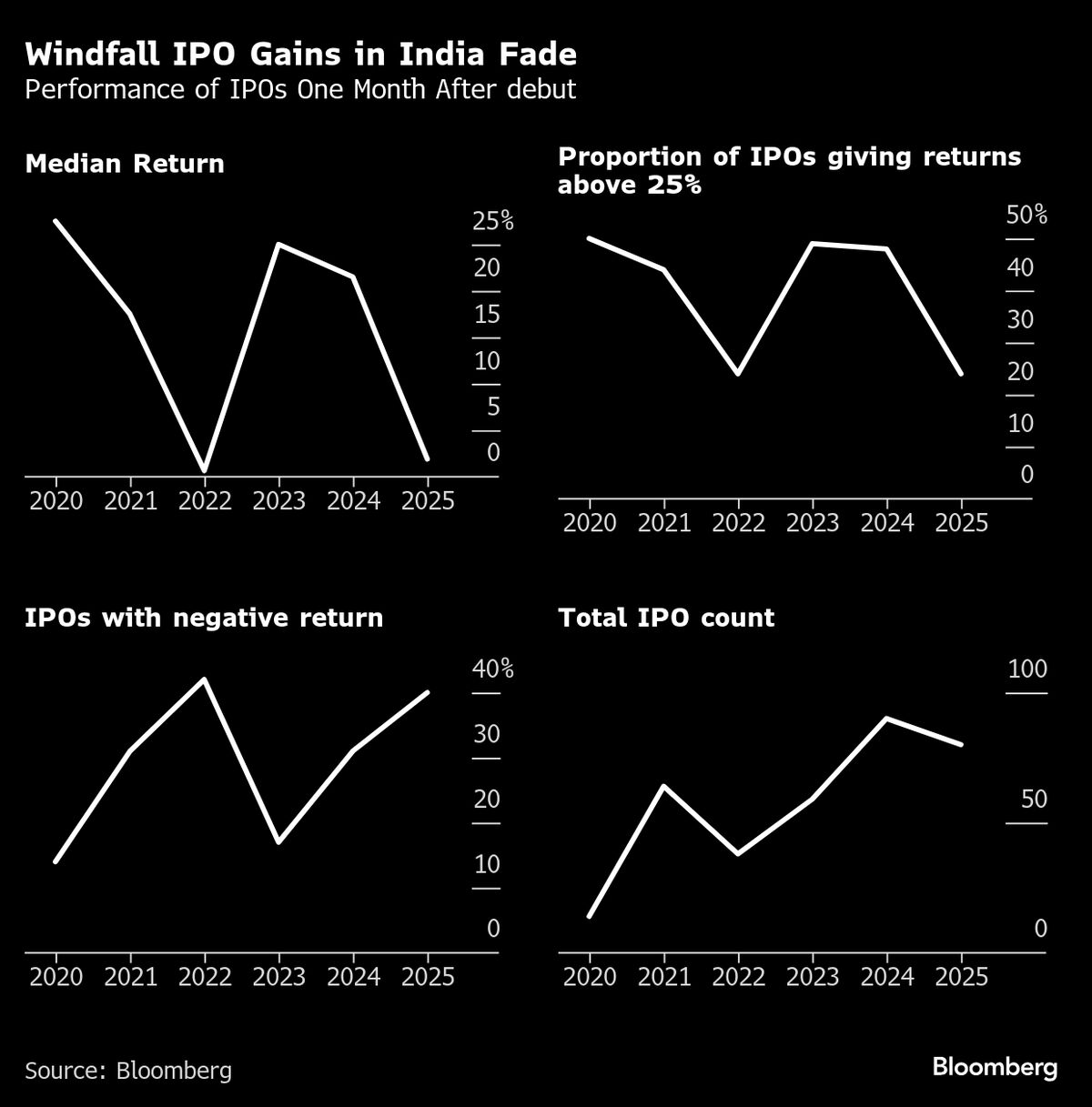

Indian Investors Turn Cautious as Big Post-Listing Gains Become Rare

NegativeFinancial Markets

Indian investors are becoming increasingly cautious as significant gains following stock listings are becoming less common. This shift in sentiment is important as it reflects broader market trends and investor confidence, which can impact future investments and economic stability.

— Curated by the World Pulse Now AI Editorial System