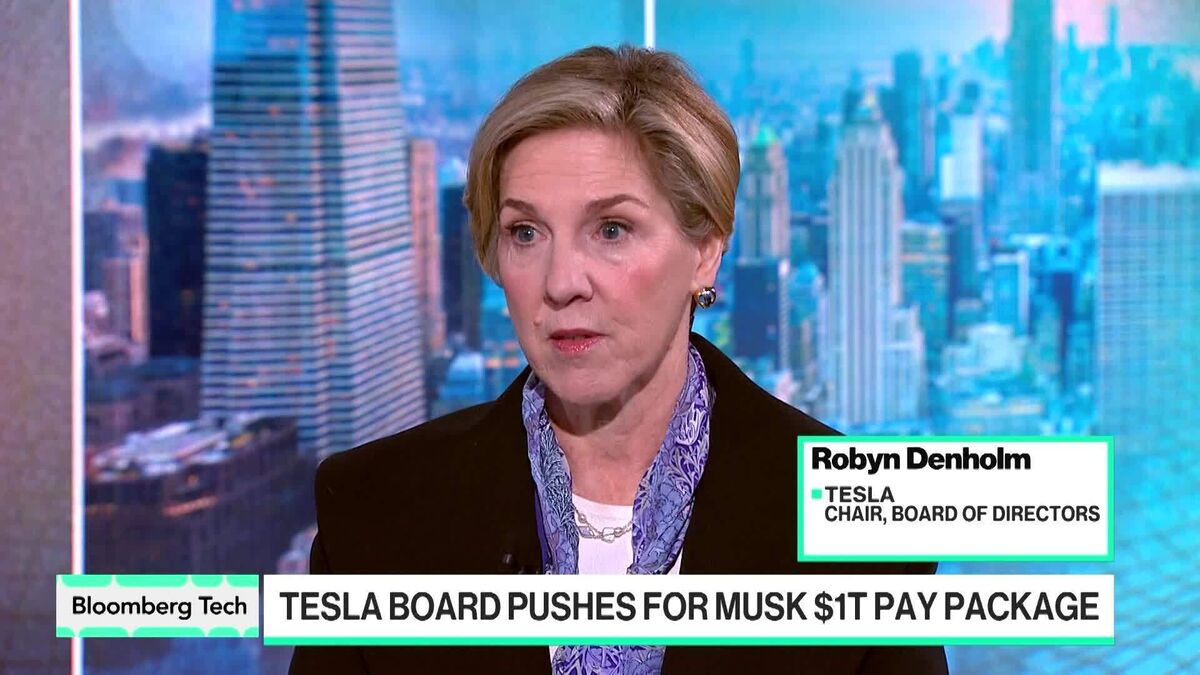

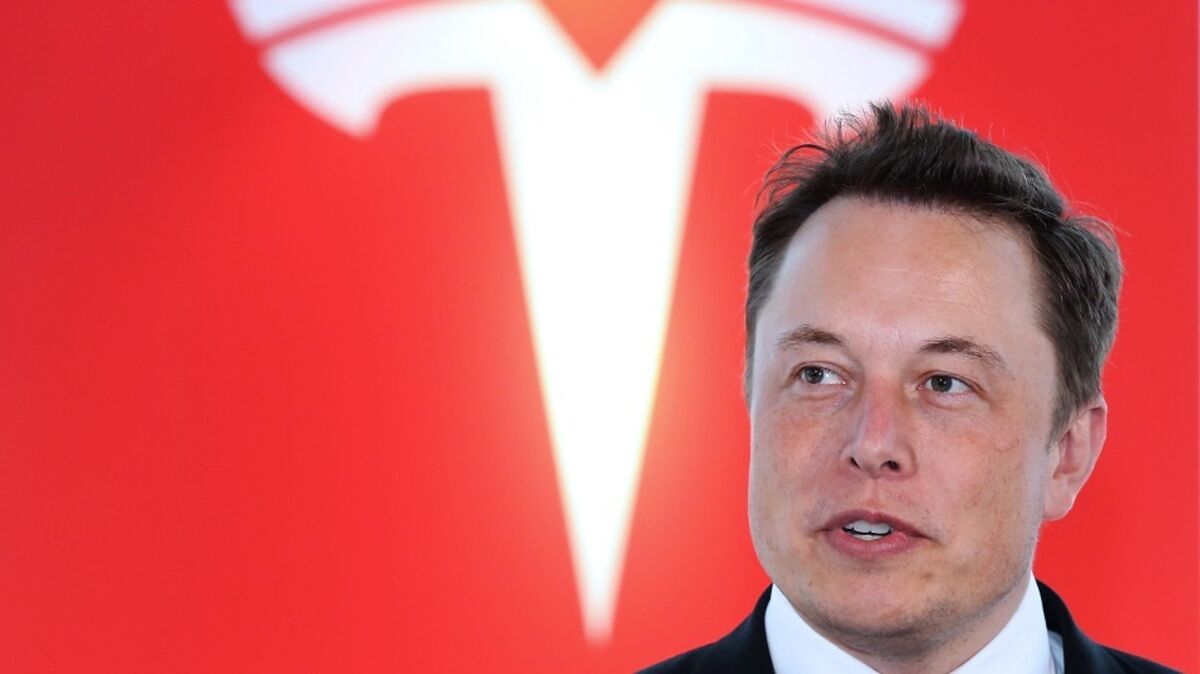

Tesla chair warns Musk could quit if shareholders reject $1tn pay deal

NegativeFinancial Markets

Tesla's chair, Robyn Denholm, has issued a warning that CEO Elon Musk may resign if shareholders reject his proposed $1 trillion pay package. This upcoming vote on November 6 is crucial, as it could significantly impact the company's leadership and future direction. Investors are urged to consider the implications of their decision, as Musk's departure could lead to uncertainty for Tesla's ambitious plans.

— Curated by the World Pulse Now AI Editorial System