‘Gold-plated Fomo’ powers bullion’s record-breaking rally

PositiveFinancial Markets

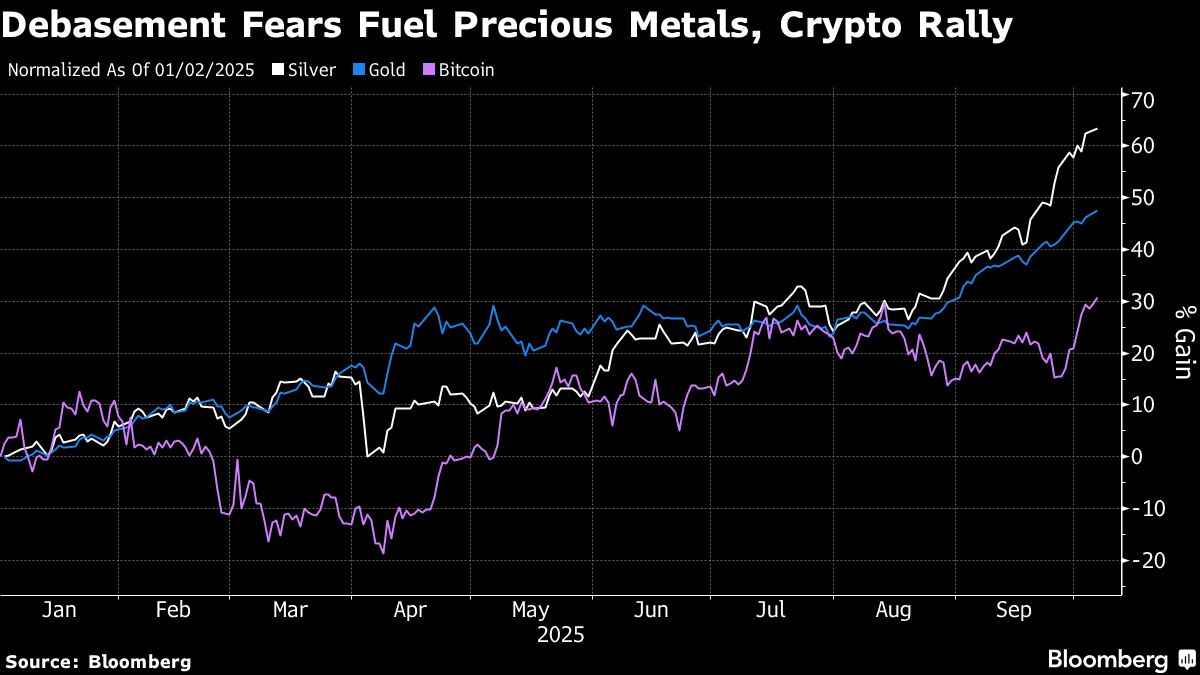

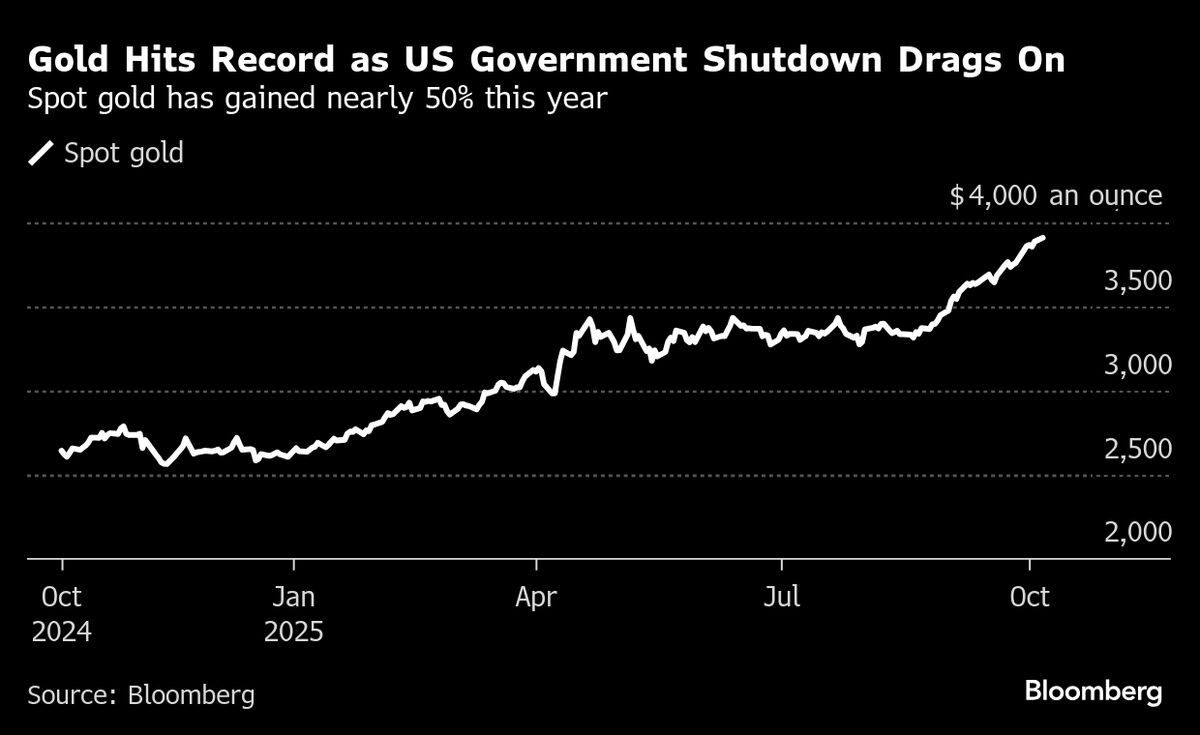

Gold has seen an incredible surge this year, skyrocketing nearly 50%, marking its best performance since 1979. This rally is largely driven by institutional investors who are flocking to bullion as a safe haven. This trend not only highlights the growing confidence in gold as a valuable asset but also reflects broader economic uncertainties, making it a significant moment for both investors and the market.

— Curated by the World Pulse Now AI Editorial System