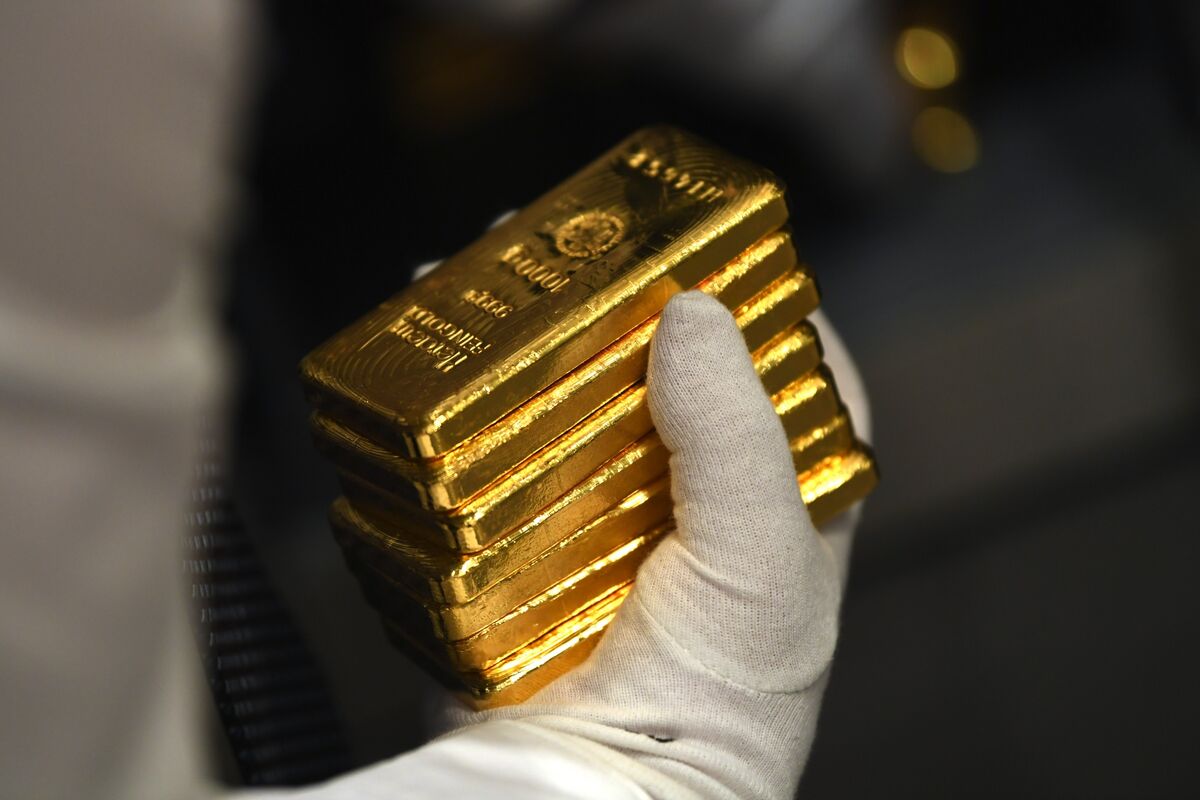

Gold drives toward $4,000 as U.S. government shutdown drags on

PositiveFinancial Markets

Gold prices are on the rise, nearing $4,000 an ounce as the U.S. government shutdown continues. This surge, with a 2.2% increase in just one week, highlights the metal's appeal as a safe haven during economic uncertainty. Investors are closely watching this trend, as it could signal broader market implications.

— Curated by the World Pulse Now AI Editorial System