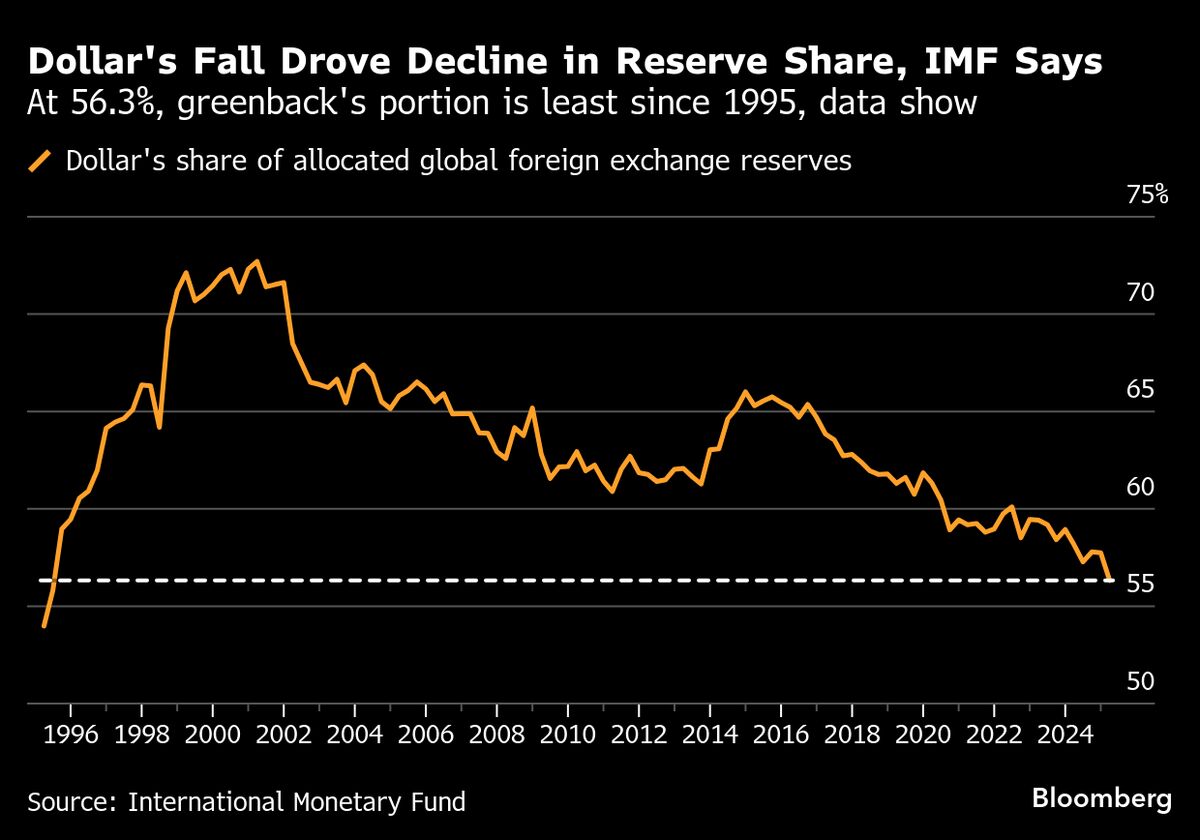

US dollar hits 30-year low in global foreign reserves – IMF

NegativeFinancial Markets

The US dollar has reached a 30-year low in global foreign reserves, according to the IMF. This decline is significant as it reflects a shift in the global economic landscape, potentially impacting international trade and investment. A weaker dollar could lead to increased costs for imports and affect the purchasing power of consumers, making it a crucial development to watch.

— Curated by the World Pulse Now AI Editorial System