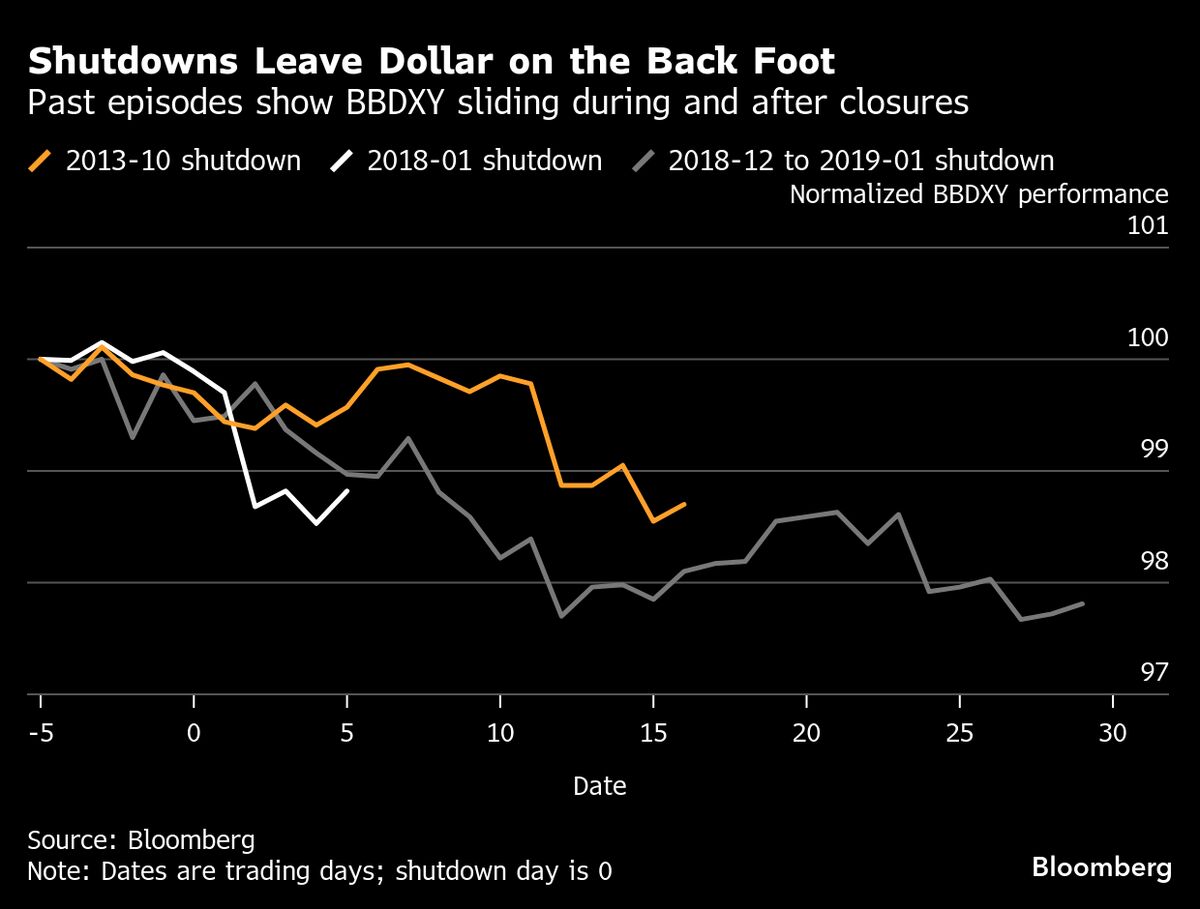

Yuan and Aussie dollar gain share in global reserves as dollar dips, IMF data shows

PositiveFinancial Markets

Recent data from the IMF reveals that the yuan and the Aussie dollar are gaining traction in global reserves, while the US dollar is experiencing a decline. This shift is significant as it indicates a diversification in currency holdings among countries, reflecting growing confidence in these currencies. As nations look to reduce their reliance on the dollar, this trend could reshape international trade and finance, making it an important development for global economic dynamics.

— Curated by the World Pulse Now AI Editorial System