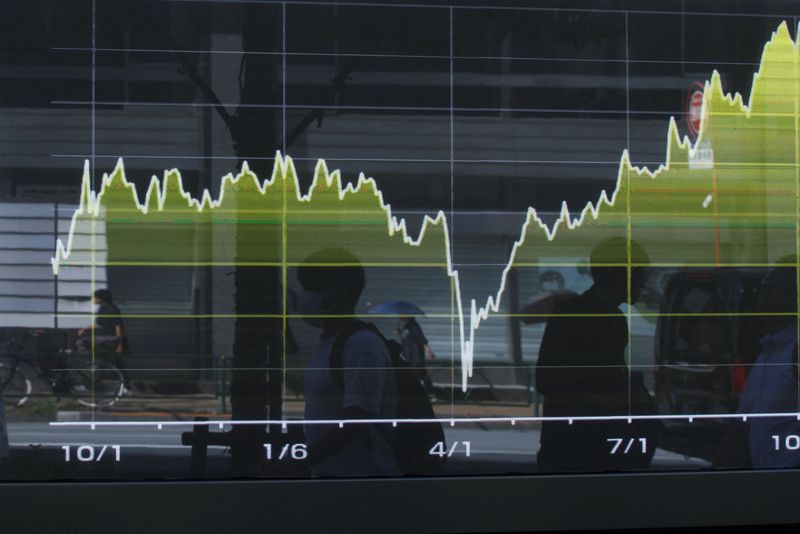

Regionals spoil the banking party

NegativeFinancial Markets

The recent regional banking crisis has disrupted the financial sector, causing concern among investors and analysts. This situation highlights the vulnerabilities within the banking system, particularly for smaller institutions that are struggling to maintain stability. As the economy faces uncertainty, the implications of this crisis could lead to tighter regulations and a reevaluation of risk management practices in the banking industry.

— Curated by the World Pulse Now AI Editorial System