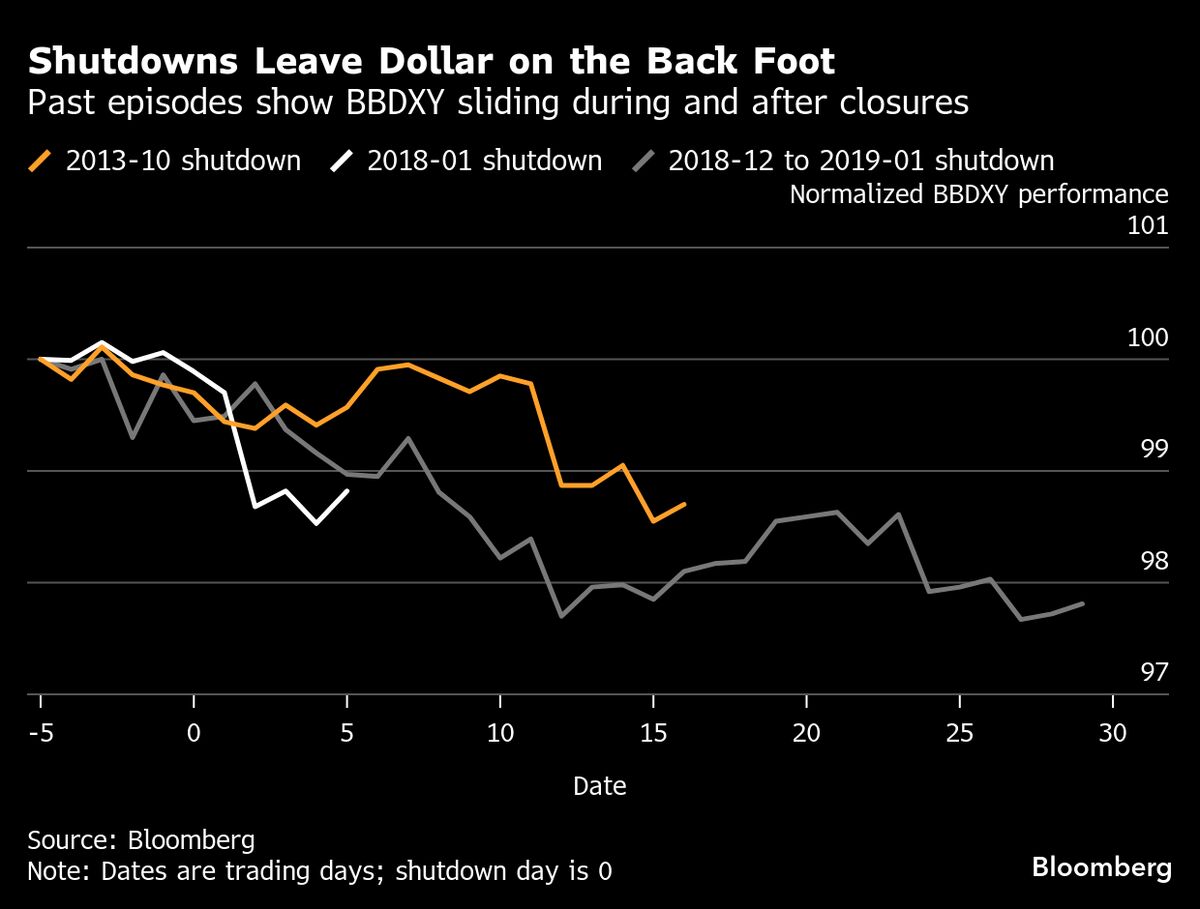

Dollar Will Suffer From US Shutdown: 3-Minute MLIV

NegativeFinancial Markets

The looming US government shutdown is expected to negatively impact the dollar, as discussed by analysts on Bloomberg's 'The Opening Trade.' This situation matters because it could lead to increased market volatility and uncertainty, affecting both investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System