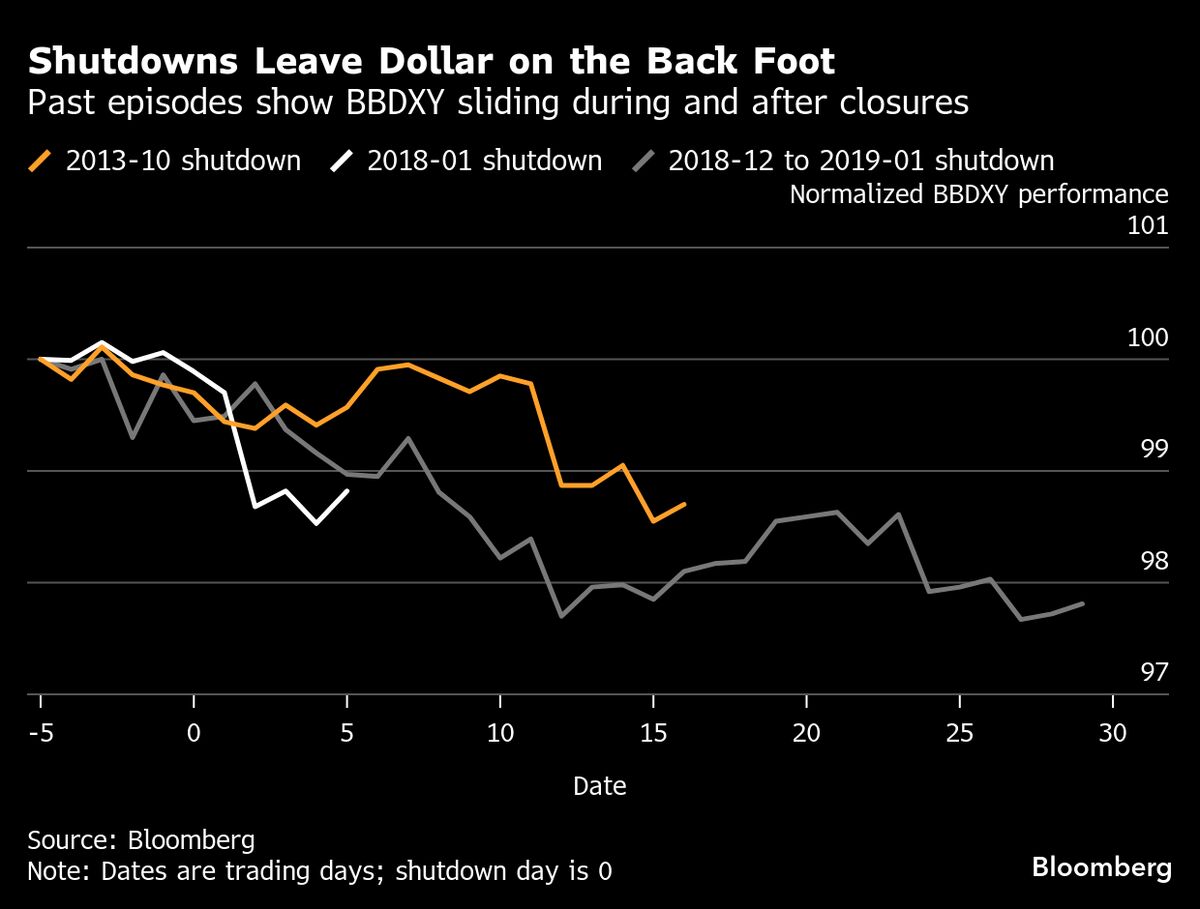

Sterling rises against shutdown-focussed dollar; set for fourth monthly loss on euro

NeutralFinancial Markets

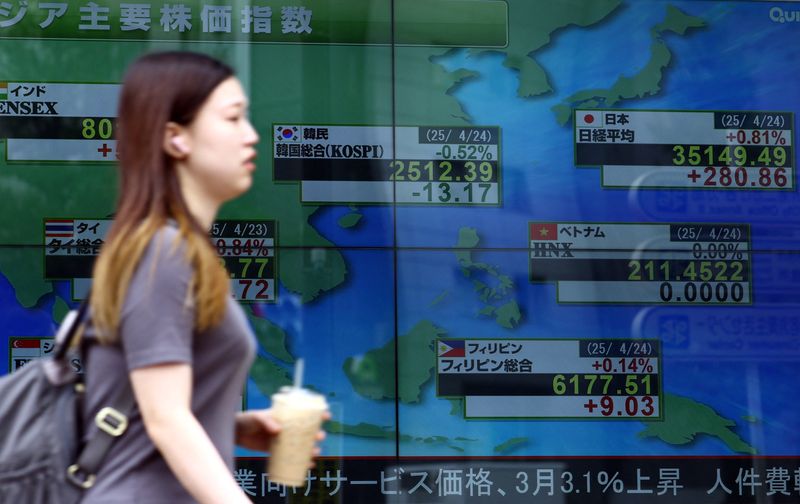

The British pound, or sterling, has gained strength against the dollar, which is currently under pressure due to concerns over a potential government shutdown. However, despite this rise, the pound is on track for its fourth consecutive monthly loss against the euro. This situation highlights the ongoing volatility in currency markets and the impact of political events on exchange rates, making it crucial for investors and businesses to stay informed.

— Curated by the World Pulse Now AI Editorial System