White House Says China Set to Restart Some Metals Exports to US

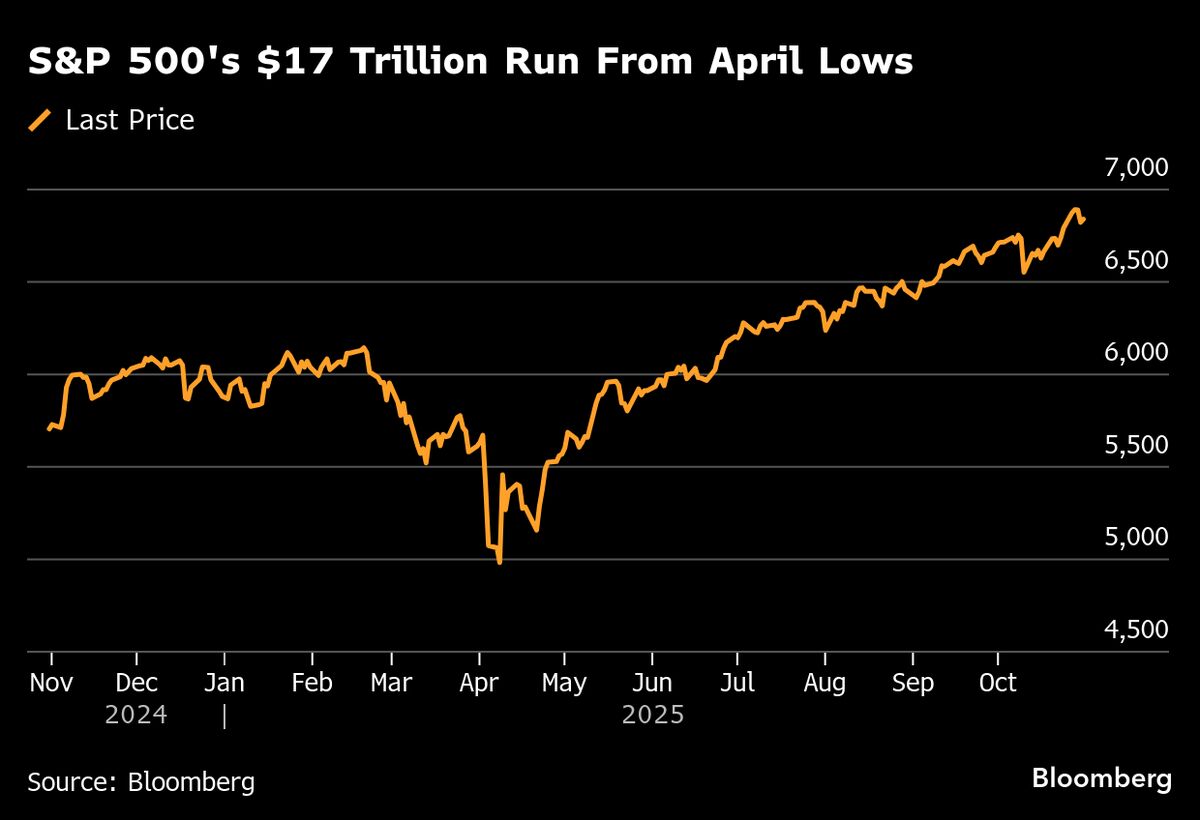

PositiveFinancial Markets

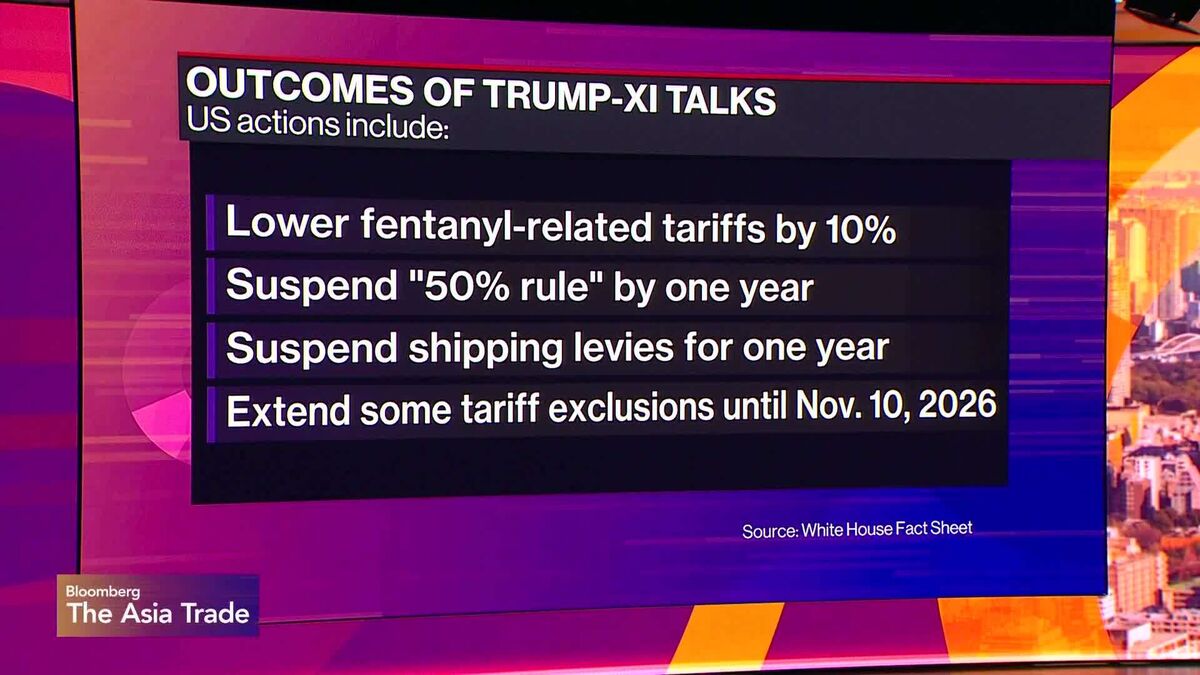

The White House has announced that China is set to restart exports of three essential metals, including gallium, to the United States as part of a trade truce. This development is significant as it marks a step towards easing trade tensions and could benefit various industries reliant on these metals, fostering better economic relations between the two countries.

— Curated by the World Pulse Now AI Editorial System