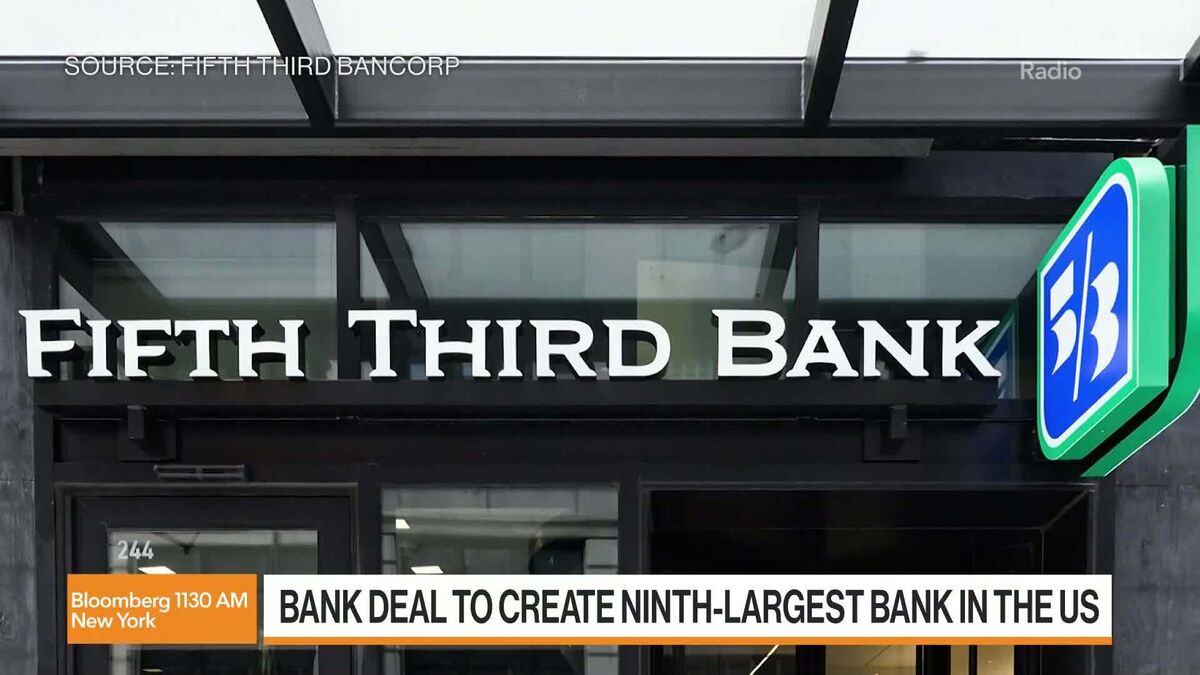

Comerica Deal Is Rare Opportunity, Fifth Third CEO Says

PositiveFinancial Markets

Fifth Third Bank's recent $10.9 billion acquisition of Comerica Inc. is being hailed as a strategic move by CEO Tim Spence, who believes this deal opens up significant growth opportunities in the Southeast. Spence shared insights on Bloomberg Open Interest, emphasizing that the timing was right for this acquisition, which could enhance Fifth Third's market presence and drive future success. This deal not only reflects confidence in the bank's direction but also highlights the potential for expansion in a rapidly growing region.

— Curated by the World Pulse Now AI Editorial System