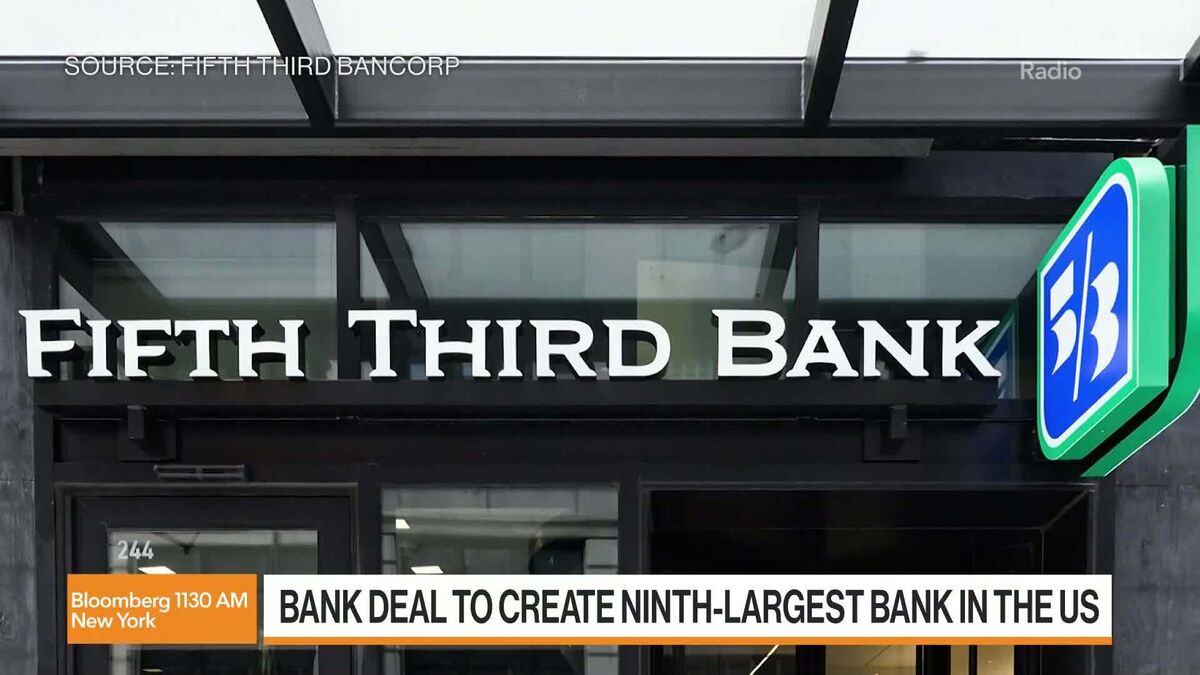

Factbox-US regional bank mergers gain momentum under Trump administration

PositiveFinancial Markets

The recent surge in US regional bank mergers under the Trump administration is reshaping the financial landscape, signaling a shift towards consolidation in the banking sector. This trend is significant as it could lead to increased efficiency and competitiveness among banks, ultimately benefiting consumers and the economy. As these mergers gain momentum, they reflect broader economic strategies and regulatory changes that could redefine how banks operate in the future.

— Curated by the World Pulse Now AI Editorial System