Political Independents And Warning Signs For Trump

NegativeFinancial Markets

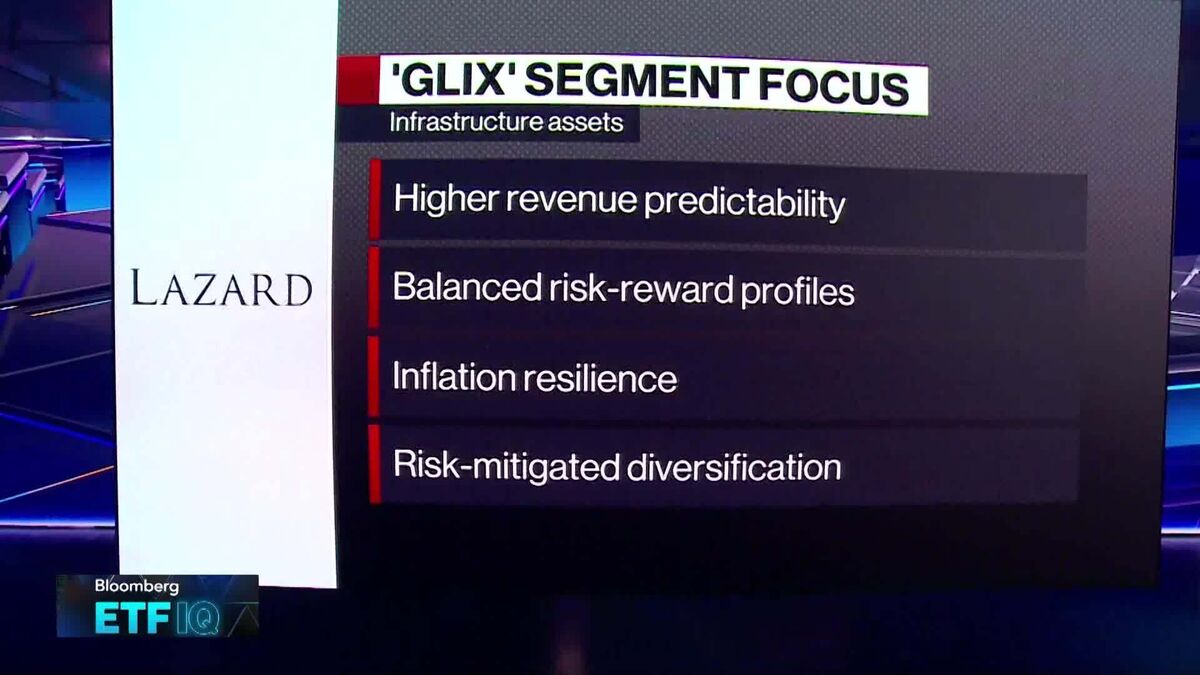

Recent polling data reveals significant weaknesses for Donald Trump, particularly regarding the economy, inflation, and tariffs. This is crucial as it highlights potential vulnerabilities that could impact his support among political independents, a key demographic in upcoming elections.

— Curated by the World Pulse Now AI Editorial System