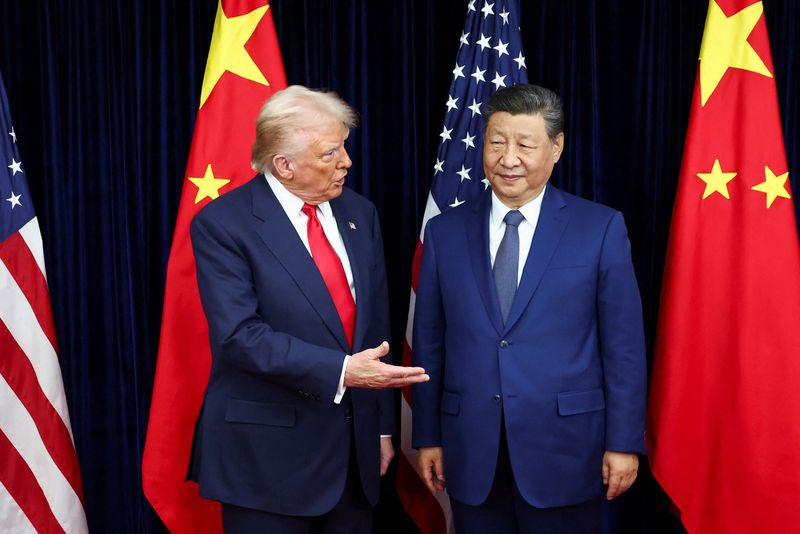

James Hardie faces board upheaval as investors react to $8.8-billion US takeover

NegativeFinancial Markets

James Hardie is experiencing significant turmoil as investors respond to the company's recent $8.8 billion takeover bid. This upheaval in the boardroom highlights the growing concerns among shareholders about the direction of the company and its leadership. The reaction from investors indicates a lack of confidence in the current management, which could lead to further instability and impact the company's future performance.

— Curated by the World Pulse Now AI Editorial System