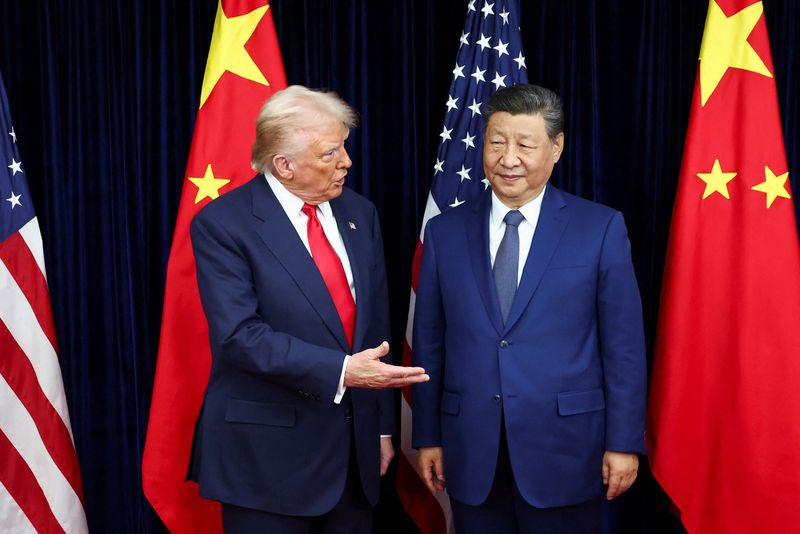

China just purchased its first U.S. soybeans from this year’s harvest before Trump and Xi meet at economic summit

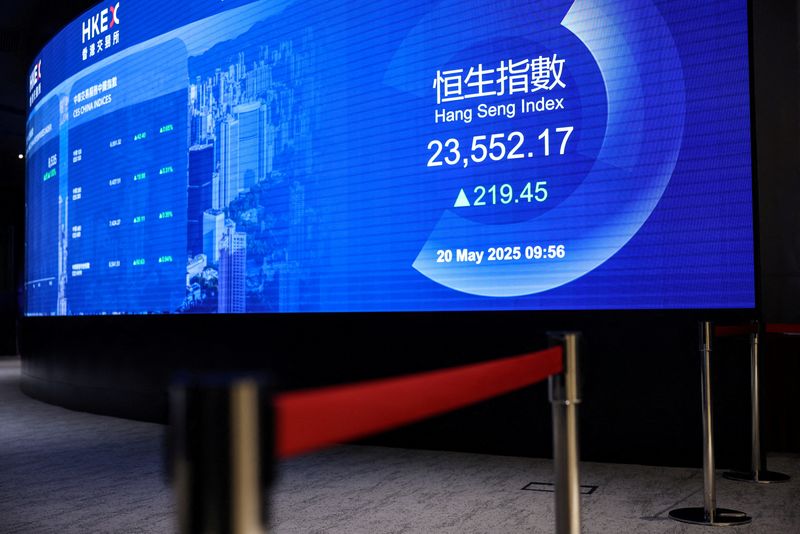

PositiveFinancial Markets

China's recent purchase of U.S. soybeans from this year's harvest is a significant step forward in trade relations, especially ahead of the upcoming economic summit between President Trump and President Xi. This development indicates a potential thaw in negotiations following China's earlier restrictions on rare-earth exports. It highlights the importance of agricultural trade in the broader context of U.S.-China relations and suggests that both nations are eager to find common ground.

— Curated by the World Pulse Now AI Editorial System